Transcribed

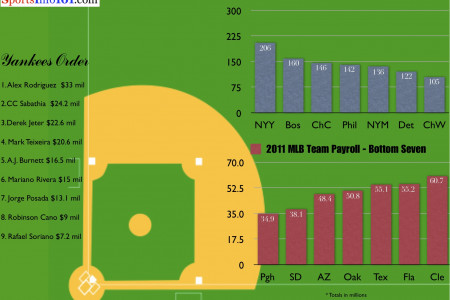

5 Common Payroll Deductions Made From An Employee's Paycheck [Infographic]

5 Common Payroll Deductions Made From An Employee���s Paycheck

FEDERAL INCOME TAX

Amount calculated on Taxable Income

Marital Status

Frequency of Pay

Number of Claimed Allowances

SOCIAL SECURITY

Flat Percentage Rate

Deduction based on Taxable Income

Also Appears as FICA Tax

MEDICARE TAX

% Flat Percentage Rate

$ Based on Taxable Income

! Also Appears as FICA

OTHER DEDUCTIONS

Insurance Policies

Deductions Vary According to State and Employer

STATE INCOME TAX

Calculated Based on W4 or State Income Tax

Marital Status

Taxable Income

Allowances

Wage Garnishment

Employers Can Withhold Earnings In Order To Pay Debt

5 Common Payroll Deductions Made From An Employee's Paycheck [Infographic]

shared by JaneKelly321 on Jul 27

25,122

views

0

faves

1

comment

An infographic on Common payroll Deductions made from an employee's Paycheck.

Source

http://allbu...-from.htmlCategory

BusinessGet a Quote

![5 Common Payroll Deductions Made From An Employee's Paycheck [Infographic] Infographic](https://i.visual.ly/images/5-common-payroll-deductions-made-from-an-employees-paycheck-infographic_50291c513a6f4_w1500.jpg)