Why Financial Planning Is Important

WHY FINANCIAL PLANNING IS IMPORTANT

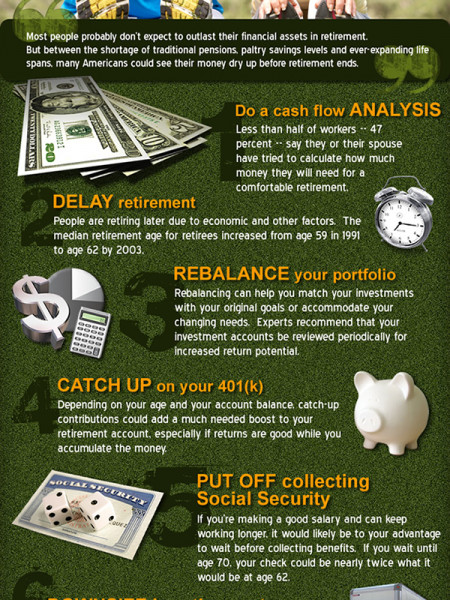

56% of U.S. adults lack a budget

40% of U.S. adults are saving less than in 2011

39% of U.S. adults have ZERO non-retirement savings

39% of U.S. adults carry credit card debt from month to month

31.4$ of all mortgage borrowers are underwater

41% of Baby Boomers do not have a Will

50% of Americans with children do not have a Will

25 million people are underinsured

16% of Americans are very confident that their investments will increase in value

23% of Americans are not at all confident in having a comfortable retirement

1991

11% of workers expect to retire after age 65

2012

37% of workers expect to retire after age 65

These statistics are pretty grim, aren't they?

Here's why...

2 in 5 U.S. adults gave themselves a C, D, or F on their knowledge of personal finance

If people took the time to educate themselves on basic personal financial principles, they would understand the importance of prudent financial planning -- for the short and long term.

To take it a step further, people can seek the counsel of an independent, qualified financial planner who has the education, experience, knowledge, and character to guide their personal financial needs.

What Does the Financial Planning Process Entail?

Sharing your life goals, values and philosophies about money and finances with your planner.

Cultivating a relationship with your planner based upon mutual trust and respect.

Determining your net worth by identifying all of your assets and liabilities.

Gathering detailed information about your daily, monthly and yearly expenditures.

Constructing a cash flow statement based on your income and expenses.

Analyzing your spending habits and developing a workable budget that you can stick to.

Gathering and analyzing financial statements from banks and brokerages, estate documents, insurance policies, real estate holdings and employee benefit plans.

Discussing various life planning assumptions (rate of return, inflation rate, savings ratios, etc.), identifying long and short term goals, then mapping out various paths to take to realize those goals based upon those assumptions.

At all times during this process, your planner will be acting as a fiduciary agent for you -- your best interest will always be paramount.

What Questions Can a Financial Planner Answer?

At what age can I afford to retire?

What financial changes can I expect after I get married?

How can my finance and I prepare for our wedding?

How much can I contribute toward my kid's education and still stay on track to reach my retirement goals?

What is my net worth?

How will having another child impact our family's financial goals?

How much can I afford to pay for a house?

How much should I be saving each month to reach my short and long term financial goals?

What is the best vehicle I can use to save for my future?

What types of insurance do I need to safeguard my family?

How much do I spend and what do I spend it on?

What are some practical strategies to improve my cash flow?

Is my portfolio diversified? What exactly does "diversification" mean?

How do I evaluate my comfort level with the risks inherent in investment purchases?

Are my investments allocated appropriately for my age and risk tolerance?

Will you make specific "buy or sell" recommendations for my portfolio?

What documents do I need in place to protect my family and myself if I were to die or become incapacitated?

What tax savings strategies are available to me?

Am I taking advantage of all the benefit plans my employer offers?

How will inflation impact my retirement goals? WHY FIMANGIAL PLAMNING IS IMPORTANT 56% 1234567890 of U.S. adults lack a budget of 40% of U.S. adults are saving less than in 2011 39% of U.S. adults have ZERO non-retirement savings CARD 1234 5678 9023 6012 39% of U.S. adults carry credit card debt from month to month 31.4%. of all mortgage borrowers are underwater 41% of Baby Boomers do not have a Will 50% of Americans with children do not have a Will 25 million people are underinsured 16% of Americans are very confident that their investments will increase in value 23% of Americans are not at all confident in having a comfortable retirement 1991 2012 11% of workers 37% of workers expect to retire after age 65 expect to retire after age 65 These statistics are pretty grim, aren't they? Here's why... 2 in 5 U.S. adults gave themselves a C, D, or F on their knowledge of personal finance 7 10 If people took the time to educate themselves on basic personal financial principles, they would understand the importance of prudent financial planning – for the short and long term. To take it a step further, people can seek the counsel of an independent, qualified financial planner who has the education, experience, knowledge, and character to guide their personal financial needs. What Does the Financial Planning Process Entail? Sharing your life goals, values and philosophies about money and finances with your planner. Cultivating a relationship with your planner based upon mutual trust and respect. Determining your net worth by identifying all of your assets and liabilities. Gathering detailed information about your daily, monthly and yearly expenditures. Constructing a cash flow statement based on your income and expenses. Analyzing your spending habits and developing a workable budget that you can stick to. Gathering and analyzing financial statements from banks and brokerages, estate documents, insurance policies, real estate holdings and employee benefit plans. Discussing various life planning assumptions (rate of return, inflation rate, savings ratios, etc.), identifying long and short term goals, then mapping out various paths to take to realize those goals based upon those assumptions. At all times during this process, your planner will be acting as a fiduciary agent for you – your best interest will always be paramount. What Questions Can a Financial Planner Answer? At what age can l afford to retire? What financial changes can lexpect after I get married? How can my fiancé and I prepare for our wedding? How much can l contribute toward my kid's education and still stay on track to reach my retirement goals? What is my net worth? How will having another child impact our family's financial goals? How much can l afford to pay for a house? How much should I be saving each month to reach my short and long term financial goals? What is the best vehicle I can use to save for my future? What types of insurance do I need to safeguard my family? How much do I spend and what do I spend it on? What are some practical strategies to improve my cash flow? Is my portfolio diversified? What exactly does "diversification" mean? How do I evaluate my comfort level with the risks inherent in investment purchases? Are my investments allocated appropriately for my age and risk folerance? Will you make specific“buy or sell' Commendations for my portfolio? What documents do I need in place to protect my family and myself if1 were to die or become incapacitated? What tax savings strategies are available to me? Am I taking advantage of all the benefit plans my employer offers? How will inflation impact my retirement goals? ONAPFA THE NATIONAL ASSOCIATION OF PERSONAL FINANCIAL ADVISORS © Copyright - National Association of Personal Financial Advisors (NAPFA) WHY FIMANGIAL PLAMNING IS IMPORTANT 56% 1234567890 of U.S. adults lack a budget of 40% of U.S. adults are saving less than in 2011 39% of U.S. adults have ZERO non-retirement savings CARD 1234 5678 9023 6012 39% of U.S. adults carry credit card debt from month to month 31.4%. of all mortgage borrowers are underwater 41% of Baby Boomers do not have a Will 50% of Americans with children do not have a Will 25 million people are underinsured 16% of Americans are very confident that their investments will increase in value 23% of Americans are not at all confident in having a comfortable retirement 1991 2012 11% of workers 37% of workers expect to retire after age 65 expect to retire after age 65 These statistics are pretty grim, aren't they? Here's why... 2 in 5 U.S. adults gave themselves a C, D, or F on their knowledge of personal finance 7 10 If people took the time to educate themselves on basic personal financial principles, they would understand the importance of prudent financial planning – for the short and long term. To take it a step further, people can seek the counsel of an independent, qualified financial planner who has the education, experience, knowledge, and character to guide their personal financial needs. What Does the Financial Planning Process Entail? Sharing your life goals, values and philosophies about money and finances with your planner. Cultivating a relationship with your planner based upon mutual trust and respect. Determining your net worth by identifying all of your assets and liabilities. Gathering detailed information about your daily, monthly and yearly expenditures. Constructing a cash flow statement based on your income and expenses. Analyzing your spending habits and developing a workable budget that you can stick to. Gathering and analyzing financial statements from banks and brokerages, estate documents, insurance policies, real estate holdings and employee benefit plans. Discussing various life planning assumptions (rate of return, inflation rate, savings ratios, etc.), identifying long and short term goals, then mapping out various paths to take to realize those goals based upon those assumptions. At all times during this process, your planner will be acting as a fiduciary agent for you – your best interest will always be paramount. What Questions Can a Financial Planner Answer? At what age can l afford to retire? What financial changes can lexpect after I get married? How can my fiancé and I prepare for our wedding? How much can l contribute toward my kid's education and still stay on track to reach my retirement goals? What is my net worth? How will having another child impact our family's financial goals? How much can l afford to pay for a house? How much should I be saving each month to reach my short and long term financial goals? What is the best vehicle I can use to save for my future? What types of insurance do I need to safeguard my family? How much do I spend and what do I spend it on? What are some practical strategies to improve my cash flow? Is my portfolio diversified? What exactly does "diversification" mean? How do I evaluate my comfort level with the risks inherent in investment purchases? Are my investments allocated appropriately for my age and risk folerance? Will you make specific“buy or sell' Commendations for my portfolio? What documents do I need in place to protect my family and myself if1 were to die or become incapacitated? What tax savings strategies are available to me? Am I taking advantage of all the benefit plans my employer offers? How will inflation impact my retirement goals? ONAPFA THE NATIONAL ASSOCIATION OF PERSONAL FINANCIAL ADVISORS © Copyright - National Association of Personal Financial Advisors (NAPFA)

Why Financial Planning Is Important

Source

Unknown. Add a sourceCategory

How ToGet a Quote