Investment Consulting vs. Investment Manager

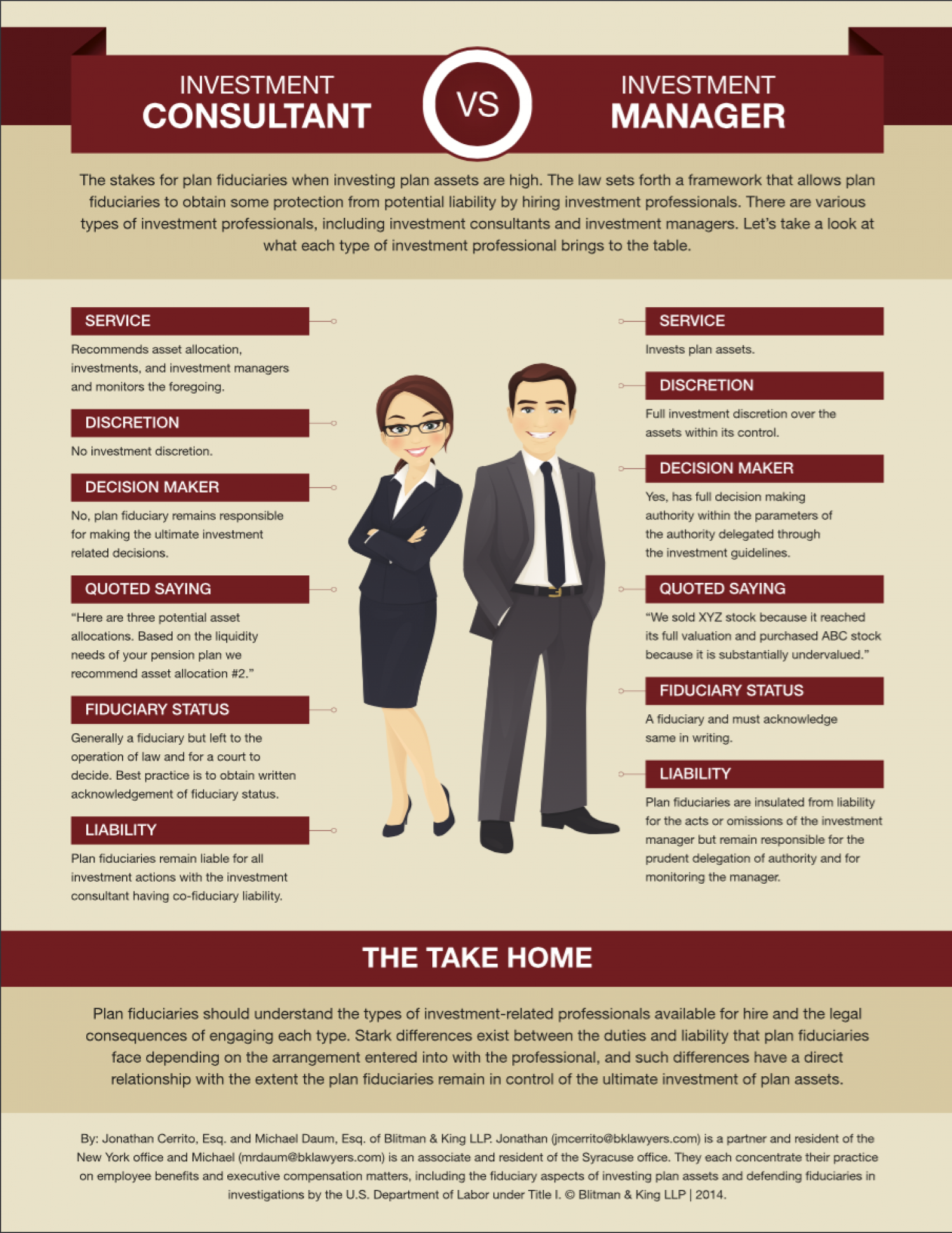

INVESTMENT INVESTMENT CONSULTANT VS MANAGER The stakes for plan fiduciaries when investing plan assets are high. The law sets forth a framework that allows plan fiduciaries to obtain some protection from potential liability by hiring investment professionals. There are various types of investment professionals, including investment consultants and investment managers. Let's take a look at what each type of investment professional brings to the table. SERVICE SERVICE Recommends asset allocation, Invests plan assets. investments, and investment managers and monitors the foregoing. DISCRETION Full investment discretion over the DISCRETION assets within its control. No investment discretion. DECISION MAKER DECISION MAKER Yes, has full decision making No, plan fiduciary remains responsible authority within the parameters of the authority delegated through the investment guidelines. for making the ultimate investment related decisions. QUOTED SAYING QUOTED SAYING "Here are three potential asset "We sold XYZ stock because it reached allocations. Based on the liquidity its full valuation and purchased ABC stock needs of your pension plan we because it is substantially undervalued." recommend asset allocation #2." FIDUCIARY STATUS FIDUCIARY STATUS A fiduciary and must acknowledge Generally a fiduciary but left to the same in writing. operation of law and for a court to decide. Best practice is to obtain written LIABILITY acknowledgement of fiduciary status. Plan fiduciaries are insulated from liability for the acts or omissions of the investment LIABILITY manager but remain responsible for the prudent delegation of authority and for monitoring the manager. Plan fiduciaries remain liable for all investment actions with the investment consultant having co-fiduciary liability. THE TAKE HOME Plan fiduciaries should understand the types of investment-related professionals available for hire and the legal consequences of engaging each type. Stark differences exist between the duties and liability that plan fiduciaries face depending on the arrangement entered into with the professional, and such differences have a direct relationship with the extent the plan fiduciaries remain in control of the ultimate investment of plan assets. By: Jonathan Cerrito, Esq. and Michael Daum, Esq. of Blitman & King LLP. Jonathan ([email protected]) is a partner and resident of the New York office and Michael ([email protected]) is an associate and resident of the Syracuse office. They each concentrate their practice on employee benefits and executive compensation matters, including the fiduciary aspects of investing plan assets and defending fiduciaries in investigations by the U.S. Department of Labor under Title I. © Blitman & King LLP | 2014.

Investment Consulting vs. Investment Manager

Source

http://bklawyers.com/Category

BusinessGet a Quote