How Comprehensive is Your Coverage?

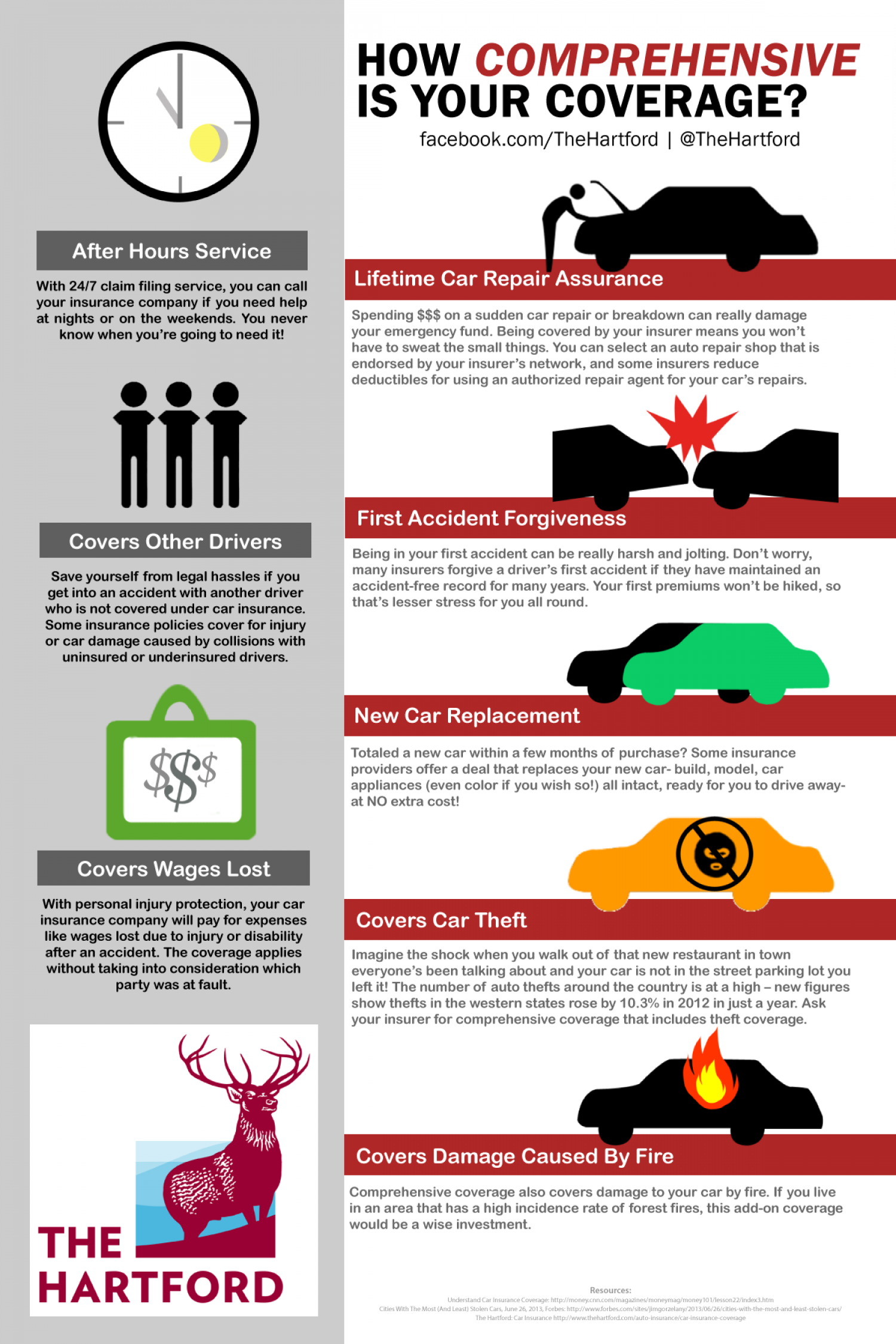

HOW COMPREHENSIVE IS YOUR COVERAGE? facebook.com/TheHartford | @TheHartford After Hours Service Lifetime Car Repair Assurance With 24/7 claim filing service, you can call your insurance company if you need help at nights or on the weekends. You never know when you're going to need it! Spending $$$ on a sudden car repair or breakdown can really damage your emergency fund. Being covered by your insurer means you won't have to sweat the small things. You can select an auto repair shop that is endorsed by your insurer's network, and some insurers reduce deductibles for using an authorized repair agent for your car's repairs. First Accident Forgiveness Covers Other Drivers Save yourself from legal hassles if you get into an accident with another driver who is not covered under car insurance. Being in your first accident can be really harsh and jolting. Don't worry, many insurers forgive a driver's first accident if they have maintained an accident-free record for many years. Your first premiums won't be hiked, so that's lesser stress for you all round. Some insurance policies cover for injury or car damage caused by collisions with uninsured or underinsured drivers. New Car Replacement Totaled a new car within a few months of purchase? Some insurance providers offer a deal that replaces your new car- build, model, car appliances (even color if you wish so!) all intact, ready for you to drive away- at NO extra cost! Covers Wages Lost With personal injury protection, your car insurance company will pay for expenses like wages lost due to injury or disability after an accident. The coverage applies without taking into consideration which party was at fault. Covers Car Theft Imagine the shock when you walk out of that new restaurant in town everyone's been talking about and your car is not in the street parking lot you left it! The number of auto thefts around the country is at a high – new figures show thefts in the western states rose by 10.3% in 2012 in just a year. Ask your insurer for comprehensive coverage that includes theft coverage. Covers Damage Caused By Fire Comprehensive coverage also covers damage to your car by fire. If you live in an area that has a high incidence rate of forest fires, this add-on coverage would be a wise investment. THE HARTFORD Resources: Understand Car Insurance Coverage: http://money.cnn.com/magazines/moneymag/money101/lesson22/index3.htm Cities With The Most (And Least) Stolen Cars, June 26, 2013, Forbes: http://www.forbes.com/sites/jimgorzelany/2013/06/26/cities-with-the-most-and-least-stolen-cars/ The Hartford: Car Insurance http://www.thehartford.com/auto-insurance/car-insurance-coverage

How Comprehensive is Your Coverage?

Designer

The HartfordSource

http://theha...e-coverageCategory

OtherGet a Quote