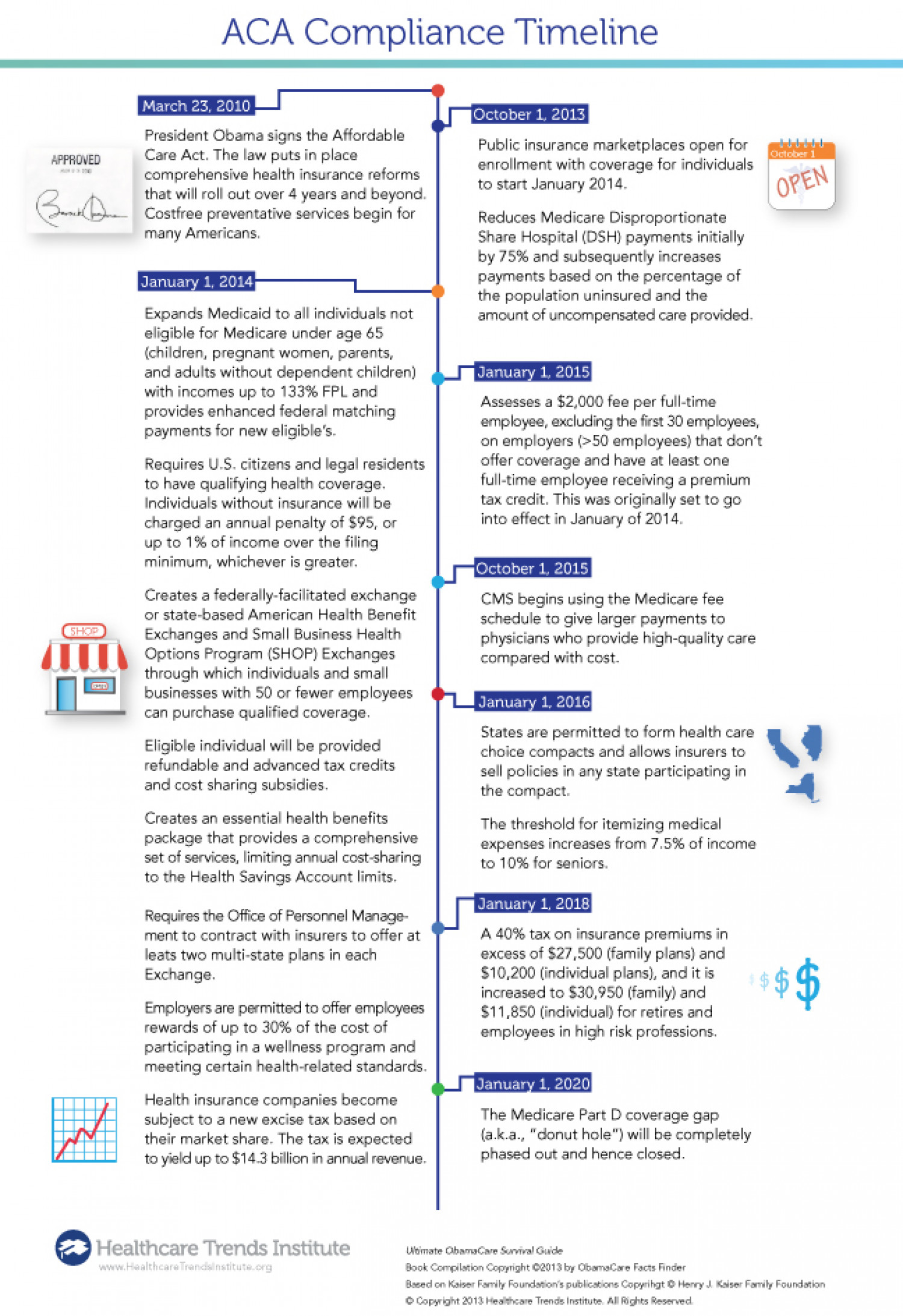

ACA Compliance Timeline

ACA Compliance Timeline March 23, 2010 October 1, 2013 President Obama signs the Affordable Care Act. The law puts in place comprehensive health insurance reforms that will roll out over 4 years and beyond. Ban Costfree preventative services begin for Public insurance marketplaces open for enrollment with coverage for individuals to start January 2014. October 1 APPROVED OPEN Reduces Medicare Disproportionate Share Hospital (DSH) payments initially by 75% and subsequently increases payments based on the percentage of the population uninsured and the amount of uncompensated care provided. many Americans. January 1, 2014 Expands Medicaid to all individuals not eligible for Medicare under age 65 (children, pregnant women, parents, and adults without dependent children) with incomes up to 133% FPL and provides enhanced federal matching payments for new eligible's. January 1, 2015 Assesses a $2,000 fee per full-time employee, excluding the first 30 employees, on employers (>50 employees) that don't offer coverage and have at least one full-time employee receiving a premium tax credit. This was originally set to go into effect in January of 2014. Requires U.S. citizens and legal residents to have qualifying health coverage. Individuals without insurance will be charged an annual penalty of $95, or up to 1% of income over the filing minimum, whichever is greater. October 1, 2015 Creates a federally-facilitated exchange or state-based American Health Benefit Exchanges and Small Business Health Options Program (SHOP) Exchanges through which individuals and small businesses with 50 or fewer employees can purchase qualified coverage. CMS begins using the Medicare fee schedule to give larger payments to physicians who provide high-quality care compared with cost. SHOP January 1, 2016 Eligible individual will be provided refundable and advanced tax credits and cost sharing subsidies. States are permitted to form health care choice compacts and allows insurers to sell policies in any state participating in the compact. Creates an essential health benefits The threshold for itemizing medical expenses increases from 7.5% of income to 10% for seniors. package that provides a comprehensive set of services, limiting annual cost-sharing to the Health Savings Account limits. January 1, 2018 Requires the Office of Personnel Manage- ment to contract with insurers to offer at A 40% tax on insurance premiums in excess of $27,500 (family plans) and $10,200 (individual plans), and it is increased to $30,950 (family) and $11,850 (individual) for retires and employees in high risk professions. leats two multi-state plans in each Exchange. Employers are permitted to offer employees rewards of up to 30% of the cost of participating in a wellness program and meeting certain health-related standards. January 1, 2020 Health insurance companies become subject to a new excise tax based on their market share. The tax is expected to yield up to $14.3 billion in annual revenue. The Medicare Part D coverage gap (a.k.a., "donut hole") will be completely phased out and hence closed. Healthcare Trends Institute Uoimate ObamaCare Survival Guide www.HealthcareTrandsinstitute.org Book Compilation Copyright 02013 by ObamaCare Facts Finder Bosed on Kaiser Family Foundation's publications Copyrihgt © Herry J. Kaiser Family Foundation O Copyright 2013 Healthcare Trends Institute. All Rights Reserved %24 %24

ACA Compliance Timeline

Source

http://www.e...imeline-2/Category

HealthGet a Quote