Facts About Consumer Debt

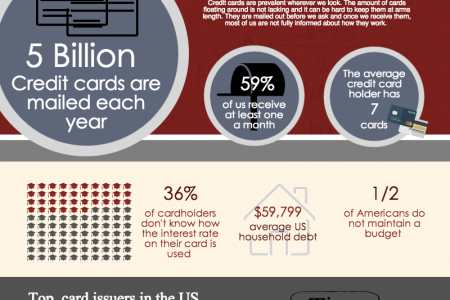

FACTS ABOUT CONSUMER DEBT U.S. household consumer debt profile $4,878 $8,220 Average credit card debt per U.S. adult, excluding zero-balance cards and store cards. Average debt per credit card that usually carries a balance. $1,037 Average debt per credit card that doesn't usually carry a balance. 2010 BANK BANK BANK More than 160 million Americans have credit cards. 2012 The average credit card holder has at least three cards. 3 CREDIT CARDS 35% of Americans have debts & unpaid bills that have been reported to collection agencies BANK KANE 1,895,834,000 Over Total number of credit cards in use in the US. 75% of Americans have at least one credit card. 77% 23% Over 40% of US families spend more than they earn. 6ANK BANK The typical credit card purchase is 112% higher than if using cash. The average US household pays $950 in interest each year. The only way to stay out of debt is to SAVE your money & only use your credit card if you can pay the whole balance off in 30 days or less. M MASTRIANI LAWFIRM Sources: http://nomorecreditcards.com/about-us/credit-card-debt-statistics/ http://www.cardhub.com/edu/2014-credit-card-landscape-report/ http://www.statisticbrain.com/credit-card-debt-statistics/ http://www.statisticbrain.com/credit-card-ownership-statistics/ http://www.nerdwallet.com/blog/credit-card-data/average-credit-card- debt-household/

Facts About Consumer Debt

Source

Unknown. Add a sourceCategory

BusinessGet a Quote