Overdraft Nation: A Visual Guide to Americans' Overdraft Fees

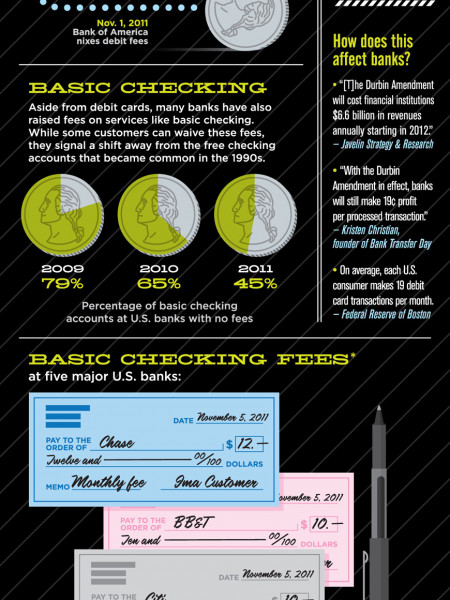

OVERDRAFT NATION How Bank Fees Are Causing Americans to Withdraw As Americans enter 2012, their choice of bank may be increasingly important. Now that regulations implemented in July 2010 limit banks' power to charge overdraft fees, many are looking for new ways to recoup the income lost from this type of service fee. We delve into the banking landscape to reveal the tricks banks might pull to take your hard-earned cash. IN 2011 AMERICANS PAID $29.5 BILLION IN OVERDRAFT FEES While that is down considerably from the $37.1 billion in 2009, it's still a whopping sum. THAT AMOUNTS TO $94.30 FOR EVERY AMERICAN OR $124.08 FOR EVERY AMERICAN OVER 18 YEARS OLD. $29.5 BILLION COULD: Provide a year's worth of clean water and sanitation for everyone in the world in need. Pay a year's tuition for 3,578,360 in-state students at an average public university in the U.S. Cover California's projected budget deficit in 2012. THE $35 CUP OF COFFEE Insufficient funds fees have turned many morning cups of reasonably priced coffee into an absurdly expensive affair. But thanks to federal regulations passed in 2010, banks are now required to provide their customers with a "way out" by offering them the right to "opt-out. Those customers who choose not to opt-in will not be able to complete a sale if the funds are not available – but will be able to avoid the pesky fees. Although less people are being pegged with insufficient funds fees, the banks are fighting back to make them more costly. AVERAGE NSF FEE: 2001 $24.70 2011 $30.83 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 Banks Fishing For Fees The federal regulations imposed on banks, though well-intentioned, have caused banks to look for income by implementing fees in other places. ATM FEES Banks are now leveraging their ATM surcharge fees to earn additional income. Fees in 2011 were higher than ever. National Average Top 5 Cities With Highest HIGHEST and Lowest ATM Fees $2.75 DENVER 2001 SAN DIEGO $2.70 ONE HOUSTON $2.69 $1.36 SEATTLE $2.63 NEW YORK CITY $2.60 2011 O LOWEST CLEVELAND $2.06 OINE MINNEAPOLIS $2.15 TAMPA $2.19 CHICAGO $2.20 $2.40 CINCINNATI $2.22 SAY GOODBYE TO FREE CHECKING The percentage of banks with assets of $50 billion or greater that offer free checking accounts is dwindling rapidly: 92.6% 38.5% That's a drop of 54 percent. On the other hand, credit unions offering free checking increased by 5.1 percent from 2010 to 2011. Q4 2009 Q2 2011 Instead, most banks are now charging customers to hold a checking account. Here are the monthly fees placed on checking accounts at the nation's five largest banks (as of October 2011): $20- Monthly fees if checking requirements are not met $15- JPMORGAN CHASE $12 $10- BANK OF AMERICA CITIGROUP U.S. BANK $8.95 $8 WELLS FARGO $5 $6.95 $5 $0 Fee is waived if the $6.95 fee with online $8.95 fee unless Fee is waived if the Fee is waived if holder holder has direct statements or $8.95 statements are account includes two has direct deposit of at least $500, maintains with paper statements. Fee is waived with deposit or maintains paperless and deposits/withdrawals of the following: direct deposit, online bill an average balance of $1,500. a minimum balance of direct deposits of at least $500 or if the holder maintains an are done completely online or by ATM. payments, ATM withdrawal, debit $1,500, or $5,000 average daily balance in linked accounts. card purchase. average balance of $1,500. Additionally, the days of a reasonable interest rate on your checking account are over. AVERAGE CHECKING ACCOUNT INTEREST YIELDS 2001 0.79% 2011 0.08% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% LESSON LEARNED: Do your research so you know all the fees associated with the accounts you hold. Fees and penalties at credit unions and community banks are often smaller, so consider moving your money. SOURCES: mint BANKRATE:COM WATER.CC CNN.COM. MOEBS.COM COLLEGEBOARD.COM ABCNEWS.GO.COM .com

Overdraft Nation: A Visual Guide to Americans' Overdraft Fees

Source

Unknown. Add a sourceCategory

EconomyGet a Quote