Living Paycheck to Paycheck: What it Takes to Make It

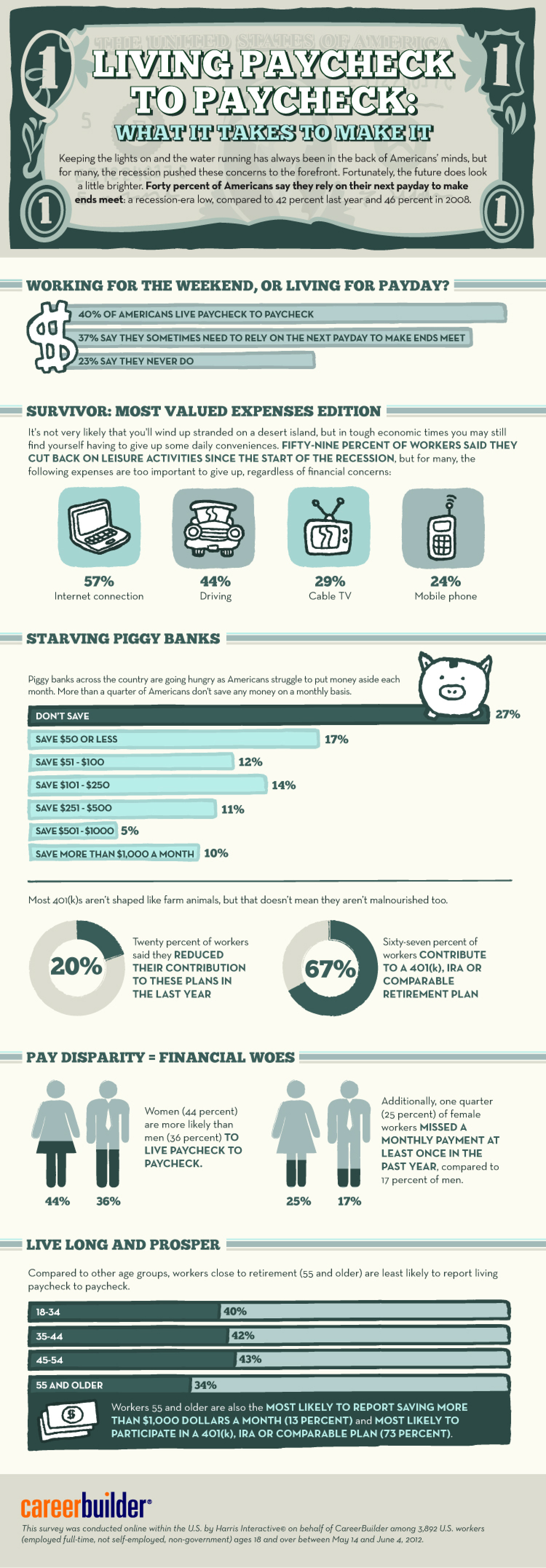

LIVING PAYCHECK 11 TO PAYCHECK: WHAT IT TAVKES TO MAKEIT Keeping the lights on and the water running has always been in the back of Americans' minds, but for many, the recession pushed these concerns to the forefront. Fortunately, the future does look a little brighter. Forty percent of Americans say they rely on their next payday to make ends meet: a recession-era low, compared to 42 percent last year and 46 percent in 2008. 1) (1) WORKING FOR THE WEEKEND, OR LIVING FOR PAYDAY? 40% OF AMERICANS LIVE PAYCHECK TO PAYCHECK 37% SAY THEY SOMETIMES NEED TO RELY ON THE NEXT PAYDAY TO MAKE ENDS MEET OD 23% SAY THEY NEVER DO SURVIVOR: MOST VALUED EXPENSES EDITION It's not very likely that you'll wind up stranded on a desert island, but in tough economic times you may still find yourself having to give up some daily conveniences. FIFTY-NINE PERCENT OF WORKERS SAID THEY CUT BACK ON LEISURE ACTIVITIES SINCE THE START OF THE RECESSION, but for many, the following expenses are too important to give up, regardless of financial concerns: 57% 44% 29% 24% Mobile phone Internet connection Driving Cable TV STARVING PIGGY BANKS Piggy banks across the country are going hungry as Americans struggle to put money aside each month. More than a quarter of Americans don't save any money on a monthly basis. DON'T SAVE 27% SAVE $50 OR LESS 17% SAVE $51 - $100 12% SAVE $101- $250 14% SAVE $251 - $500 11% SAVE $501-$1000 5% SAVE MORE THAN $1,000 A MONTH 10% Most 401(k)s aren't shaped like farm animals, but that doesn't mean they aren't malnourished too. Twenty percent of workers said they REDUCED THEIR CONTRIBUTION Sixty-seven percent of workers CONTRIBUTE TO A 401(k), IRA OR 20% 67% TO THESE PLANS IN COMPARABLE THE LAST YEAR RETIREMENT PLAN PAY DISPARITY = FINANCIAL WOES Additionally, one quarter (25 percent) of female workers MISSED A MONTHLY PAYMENT AT LEAST ONCE IN THE PAST YEAR, compared to 17 percent of men. Women (44 percent) are more likely than men (36 percent) TO LIVE PAYCHECK TO PAYCHECK. 44% 36% 25% 17% LIVE LONG AND PROSPER Compared to other age groups, workers close to retirement (55 and older) are least likely to report living paycheck to paycheck. 18-34 40% 35-44 42% 45-54 43% 55 AND OLDER 34% Workers 55 and older are also the MOST LIKELY TO REPORT SAVING MORE THAN $1,000 DOLLARS A MONTH (13 PERCENT) and MOST LIKELY TO PARTICIPATE IN A 401(k), IRA OR COMPARABLE PLAN (73 PERCENT). careerbuilder This survey was conducted online within the U.S. by Harris Interactivee on behalf of CareerBuilder among 3,892 U.S. workers (employed full-time, not self-employed, non-government) ages 18 and over between May 14 and June 4, 2012.

Living Paycheck to Paycheck: What it Takes to Make It

Source

http://www.c...fographicsCategory

EconomyGet a Quote