State of the Payments Industry: Q1 2014

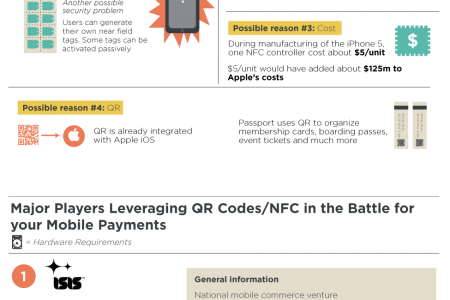

THE STATE OF PAYMENTS Quarterly Update THE LAST QUARTER OF 2013 revealed United States trends and consumer habits that will surely influence the coming year. In addition to omni-channel retailing moving to the forefront of retailers' concerns, new technologies and integrated commerce solutions will continue to play a role in evolving the point of sale (POS), the way consumers pay, and how retailers engage with their customers. CREDIT CHECK: How Much are Consumers Spending and Borrowing? INDEX OF CONSUMER SPENDING 9.1% 8.1% 7.6% 6.7% 6.5% 6.2% NON-REVOLVING 5.8% 5.9% 4.8% 6.4% TOTAL % CHANGE (ANNUAL RATE) 4.4% 1.5% 1.2% 0.4% 0.3% 0.4% REVOLVING Q3 | 2012 Q4 Q1| 2013 Q2 Q3 Q4 3,057.1 3.106.0 2,924.3 2,969.5 3,012.3 TOTAL $ CHANGE 2,877.6 (ANNUAL RATE) 2,120.4 2,160.6 2,204.6 2,244.1 2,032.5 2,078.5 NON-REVOLVING 845.1 845.8 849.1 851.6 852.4 861.9 REVOLVING Q3 | 2012 Q4 Q1| 2013 Q2 Q3 Q4 THE 2013 CONSUMER CREDIT INDEX RETAILERS DRIVING CREDIT CARD GROWTH reveals a definite trend toward increased Equifax reports that 2013 third-quarter growth on spending in both revolving and non-revolving credit general-purpose credit cards only rose 0.5%, while since 2012. Although the overall revolving credit total retail credit debt grew 7.0%, compared to third- still remains below its pre-recession levels, we now quarter 2012. have seen our eighth consecutive quarter of revolving credit growth. The 4.4% jump in revolving credit was the largest quarterly jump seen in the US since 2008. THE MOBILE WALLET: Trends and Highlights in Mobile Payments MOBILE POS PROXIMITY PAYMENTS 118% FIFTY PERCENT 50% of smartphone users predict they will use mobile wallets MOBILE-BASED TRANSACTIONS in the U.S. have grown 118% per year by the year 2017. on average for the last five years. THE MOBILE WALLET APPLICATIONS available today are primarily based on one of two technologies, however there is a dark horse competitor that may make waves in 2014. QR (QUICK RESPONSE) CODES This technology uses digital codes on users' smartphones. The code is scanned by a camera contained within a smart device (phone or tablet) or a stand-alone reader connected to the POS system, unlocking the user's payment information. QR codes can be used on almost any smartphone because they don't require hardware, which makes them increasingly popular. Companies such as Starbucks, LevelUp, and PayPal are already using them. Consumers are also becoming increasingly comfortable with the technology and its benefits, causing explosive growth in use. Starbucks processed more than $1 BILLION in mobile 4.5M each week in May 2013 transactions during 2013 and more than 5 MILLION transactions each week during the fourth quarter, up from 5M each week during Q4 2013 4.5 MILLION in May 2013. NFC (NEAR FIELD COMMUNICATIONS) This system transmits payment information between devices using radio waves. NFC is hardware-dependent, 38% NFC has been however, which means adoption 30 projected to grow will be hindered by the lack of 38% between 2011 NFC-enabled devices. By 2015, 40% 20 and 2016, with the 630 MILLION HANDSETS NFC market expected will ship with NFC, but this still 10 to reach more than only represents 40% OF ALL $10 BILLION. MOBILE PHONES. BLE (BLUETOOTH LOW ENERGY) BLE is the NFC rival that may prove to be the ultimate winner Even more enticing to developers and merchants: in the race for mobile-wallet supremacy. The BLE BLE is already on more than 200 million i0s communications frequency has a range of up to 50 meters. devices in conjunction with Apple's iBeacon Combined with Apple's iBeacon technology, it offers many platform, and many Android devices also support it. features that make it an attractive option for in-store loyalty and marketing campaigns, particularly the ability to pinpoint users' locations within stores. LOYALTY GOES MOBILE One of the strongest reasons for merchants to embrace the move to mobile wallets is the opportunity to incorporate loyalty programs for their customers, without the hassle of paper punch cards. 84% 75% 73% 84% OF CONSUMERS 75% OF CONSUMERS 73% OF SMARTPHONE USERS said they're more likely to visit would switch brands that offered are interested in interacting with the websites of retailers that real-time discounts and promotions their loyalty programs through their have loyalty programs. delivered to their smartphones mobile devices. while shopping. INFORMED INSIGHT: Predictions for the Coming Months ONLINE RETAIL SALES SEE MASSIVE GROWTH IMPORTANCE OF IMPROVED MOBILE E-commerce was the biggest winner of the 2013 holiday OPTIMIZATION FOR E-COMMERCE season. While both online and offline sales combined As customers spend more and more time on were 4.1% HIGHER THAN LAST YEAR, e-commerce their mobile devices, it is increasingly important sales alone GREW BY 12%. for merchants to improve their online shopping and mobile browsing experiences. In Q4 2013, smartphones and tablets accounted for almost 35% OF ONLINE TRAFFIC-a 40% INCREASE COMPARED TO Q4 2012. More importantly not only is traffic increasing from mobile devices but so are sales, $t 16.6% OF ONLINE SALES WERE MADE THROUGH MOBILE DEVICES THIS PAST HOLIDAY SEASON, UP 46% 35% Q4 2012 COMPARED TO THE 2012 HOLIDAY of ONLINE TRAFFIC in Q4 2013 SEASON. DEBIT USE DRAMATICALLY INCREASED: Beyond the increased use of credit cards, according to the most recent data from MasterCard, debit card spending has seen significant increases since as far back as 2007. Not only has the number of debit cards in the U.S. increased from 113 million to 143 MILLION (2012 number), but also the overall yearly spend per debit card has grown from $2,380 per year to $3,132 (2012 number). $2,380 yearly spend per debit card in 2007 $3,132 Average debit card debt in 2013 INDUSTRY PULSE: Trends and Regulatory Updates EMV ROLLOUT Merchants face an October 2015 liability shift for their card transactions, at which point the actual liability for fraudulent transactions will fall on the businesses themselves. EMV ADOPTION RAMPING UP EMV CARDS Encrypted cards currently only make up about 1%-5% total credit cards now in circulation 1%-5% of total card circulation in the U.S., but rapid card turnover and commitment from the banking industry has experts expecting this number to climb to 90%-95% within the next 2 years. total credit cards 90%-95% in circulation in the next 2 years Recent issues of credit card fraud, such as the Target breach, will place a heightened focus on fraud prevention technologies. Merchants should continue to investigate and prepare their businesses for these changes. In an effort to better secure its systems, Target representation has said the entire chain will be accepting EMV cards by January 2015–10 months ahead of the liability shift deadline set by card payment brands. LAUNCH OF MCX Announced in August 2012 and expected to launch this year, the Merchant Customer Exchange (MCX) is an attempt by more than 55 retailers to provide their customers with a singular mobile wallet option. While initially available to only Tier 1 and Tier 2 big-box retailers, expansion plans are in the works to include small to mid-sized retailers. The technology is expected to leverage barcode and QR technology at launch and offer consumers a singular mobile commerce option, allowing them to leverage multi-layer rewards and loyalty programs. MCX's recent partnership with Paydiant will allow MCX members to integrate complete mobile wallet capabilities and value-added services into their own branded iPhone and Android applications. Going beyond payments, the MCX wallet will allow merchants to develop integrated loyalty and rewards programs. Yankee Group analyst Jordan McKee says, "Consumers don't just want another way to pay; there's a tremendous opportunity with loyalty.' Merchant Warehouse SOURCES: Federal Reserve | Business Insider | NASDAQ | Forbes | Merchant Warehouse | Internet Retailer | Master Card | USA Today | Merchant Customer Exchange | eWeek | Mobile Commerce Daily | Access Development | Informa Telecoms and Media THE STATE OF PAYMENTS CHANGES QUICKLY. WE'RE HERE TO KEEP YOU UPDATED. OR CO

State of the Payments Industry: Q1 2014

Source

http://merch...ry/q1-2014Category

BusinessGet a Quote