The Facts Behind Refinancing

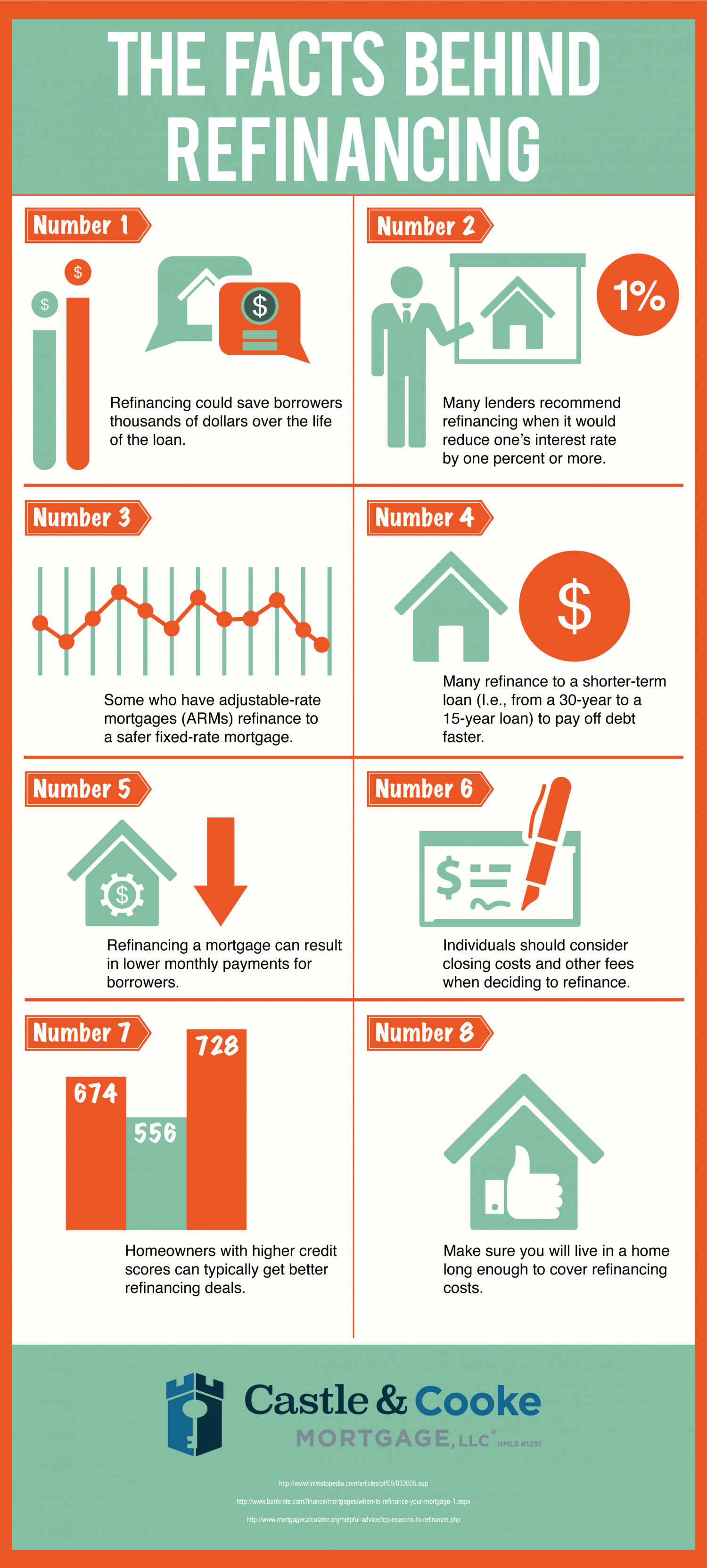

THE FACTS BEHIND REFINANCING Number 1 Number 2 1% Refinancing could save borrowers thousands of dollars over the life Many lenders recommend refinancing when it would reduce one's interest rate of the loan. by one percent or more. Number 3 Number 4 Some who have adjustable-rate mortgages (ARMS) refinance to a safer fixed-rate mortgage. Many refinance to a shorter-term loan (I.e., from a 30-year to a 15-year loan) to pay off debt faster. Number 5 Number 6 24 Refinancing a mortgage can result in lower monthly payments for Individuals should consider closing costs and other fees when deciding to refinance. borrowers. Number 7 Number 8 728 674 556 Homeowners with higher credit Scores can typically get better refinancing deals. Make sure you will live in a home long enough to cover refinancing costs. Castle & Cooke MORTGAGE, LLCs as NMLS #1251 http://www.investopedia.com/articles/pf/05/033005.asp http://www.bankrate.com/finance/mortgages/when-to-refinance-your-mortgage-1.aspx http://www.mortgagecalculator.org/helpful-advice/top-reasons-to-refinance.php %24 %24 %24 %24 %24

The Facts Behind Refinancing

Source

http://www.c...financing/Category

HomeGet a Quote