Transcribed

What's in Your Credit Score?

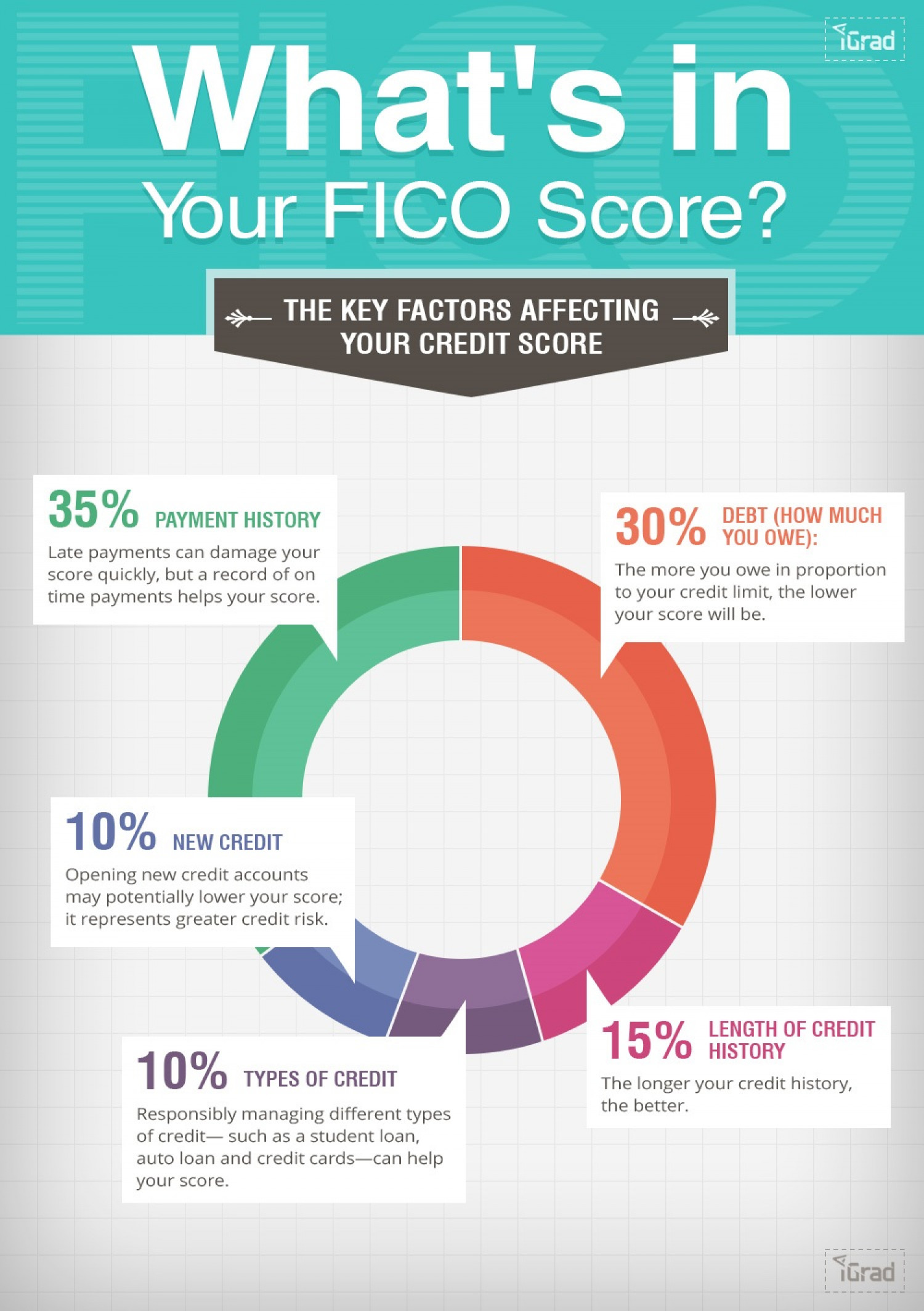

TGrad What's in Your FICO Score? THE KEY FACTORS AFFECTING YOUR CREDIT SCORE 35% 30% DEBT (HOW MUCH YOU OWE): PAYMENT HISTORY Late payments can damage your score quickly, but a record of on time payments helps your score. The more you owe in proportion to your credit limit, the lower your score will be. 10% NEW CREDIT Opening new credit accounts may potentially lower your score; it represents greater credit risk. 15% LENGTH OF CREDIT HISTORY 10% TYPES OF CREDIT The longer your credit history, the better. Responsibly managing different types of credit- such as a student loan, auto loan and credit cards-can help your score. YGrad

What's in Your Credit Score?

shared by iGrad on Jan 08

1,808

views

2

faves

0

comments

A simple infographic covering how credit scores are calculated. We all could use a reminder of what activity may hurt our ability to get credit later. For more information about your credit score visi...

t http://www.igrad.com/articles/know-your-credit-score-importance

Source

http://www.i...edit-scoreCategory

EconomyGet a Quote