Value Added Tax (VAT)

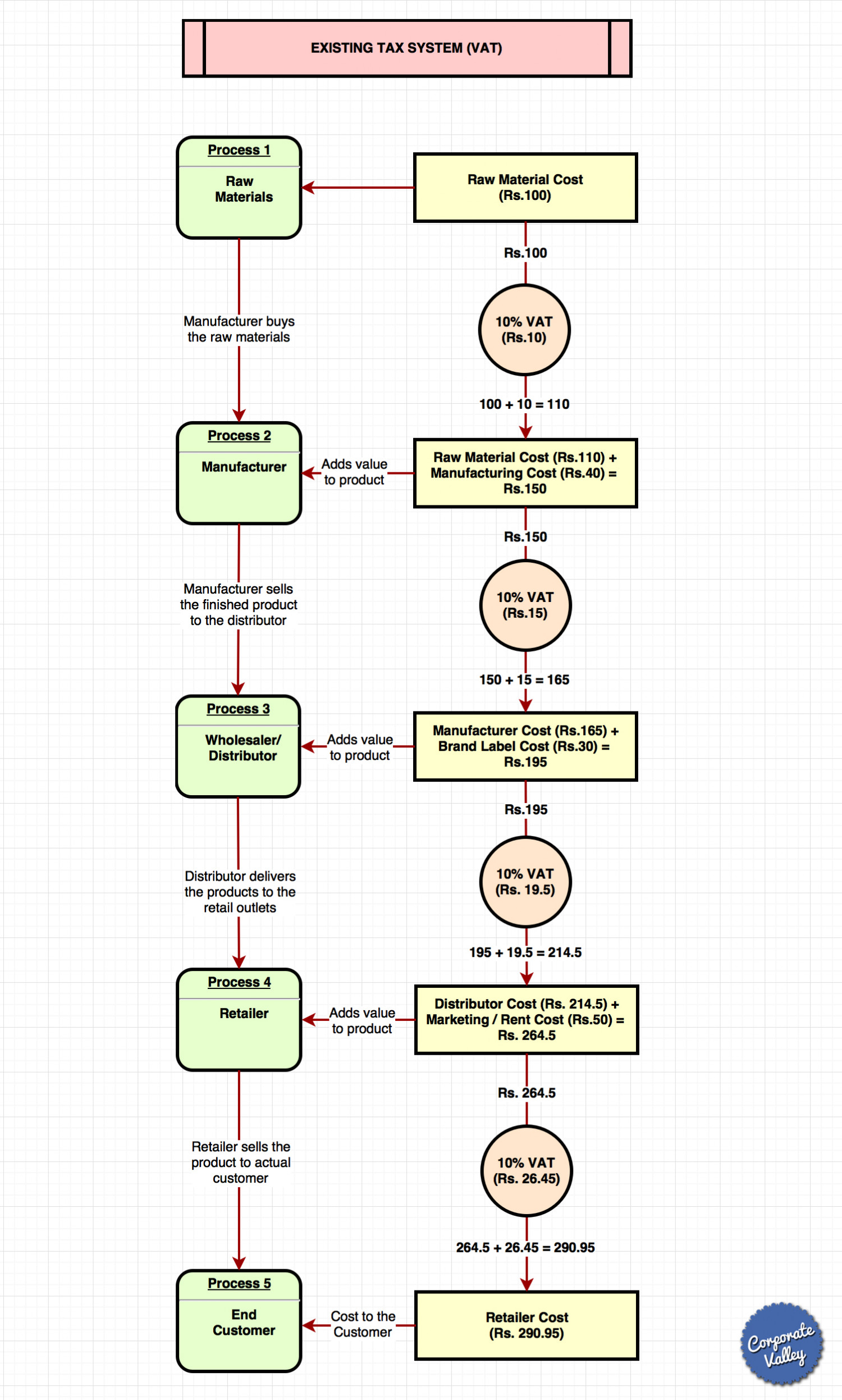

EXISTING TAX SYSTEM (VAT) Process 1 Raw Raw Material Cost Materials (Rs.100) Rs.100 Manufacturer buys 10% VAT the raw materials (Rs.10) 100 + 10 = 110 Process 2 Raw Material Cost (Rs.110) + Manufacturing Cost (Rs.40) = Rs.150 Manufacturer Adds value to product Rs.150 Manufacturer sells the finished product 10% VAT (Rs.15) to the distributor 150 + 15 = 165 Process 3 Adds value to product Manufacturer Cost (Rs.165) + Brand Label Cost (Rs.30) = Wholesaler/ Distributor Rs.195 Rs.195 Distributor delivers 10% VAT (Rs. 19.5) the products to the retail outlets 195 + 19.5 = 214.5 Process 4 Adds value to product Distributor Cost (Rs. 214.5) + Marketing / Rent Cost (Rs.50) = Rs. 264.5 Retailer Rs. 264.5 Retailer sells the product to actual 10% VAT customer (Rs. 26.45) 264.5 + 26.45 = 290.95 Process 5 End Cost to the Customer Retailer Cost Corgorate Valley Customer (Rs. 290.95)

Value Added Tax (VAT)

Source

http://www.c...alley.com/Category

EconomyGet a Quote