Transcribed

Papua New Guinea : Selected economic indicators (%), Public debt sources

3.33.1 Selected economic indicators (%) 2013 2014 GDP growth 5.5 6.0 Inflation 6.5 7.5 Current account balance -15.1 -8.4 (share of GDP) Source: ADB estimates. 3.33.6 Public debt sources Undetermined source Domestic, greater than 12 month maturity Domestic, less than 12 month maturity Foreign, commercial loans Foreign, multilateral banks % of GDP 40_ 30_ 20_ 10_ 0_L 2011 2012 2013 2014 Forecast Sources: PNG Department of Treasury. 2012. 2013 National Budget. December; ADB estimates.

Papua New Guinea : Selected economic indicators (%), Public debt sources

shared by PARMIONOVA on Apr 26

126

views

0

faves

0

comments

The 2013 current account deficit is expected to narrow to 15.1% of GDP

as reduced LNG capital imports reduce the trade deficit. A rebound in

production at existing mines and the ramping up of producti...

on at the

Ramu facility will help boost export earnings. A further narrowing of the current account deficit to 8.4% of GDP is expected in 2014 as LNG exports begin.

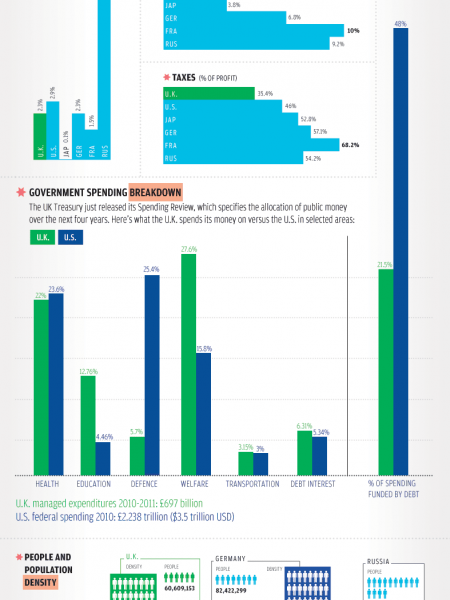

Although large budget deficits are planned for 2013 and 2014, public

debt is expected to remain low by historical standards, peaking at 35% of

GDP in 2014. While such public indebtedness is moderate, PNG will need

to ensure that higher spending does not undermine the fiscal buffers that

have allowed it to withstand recent shocks (Figure 3.33.6).

Foremost is the need for spending to remain in line with the

government’s own deficit-reduction plan. To keep public debt below 35%

of GDP, the 2013 budget plans for zero nominal growth in government

wages and salaries and just 2.5% annual growth in spending on goods

and services up to 2017. Such recurrent expenditure restraint will be

difficult to achieve and risks starving service delivery by, for example,

undercutting salaries for teachers and health workers. The government

may therefore need to reprioritize spending away from capital investment

and toward recurrent goods and services to ensure service delivery within

designated spending limits.

The government faces growing challenges in financing its deficit

spending. While domestic bank liquidity remains high, local commercial

banks are approaching regulatory limits on their lending to the

government. A result will likely be deficit financing sourced from

international markets in 2013 and 2014, significantly increasing the

government’s cost of borrowing and exposure to exchange rate risk.

Fiscal risks arising from the budget must be better coordinated

with those generated separately. The reduction in public debt over the

past decade has been offset by a rise in off-budget liabilities, which now

equal between 15%–20% of GDP. Major components include borrowing

to finance the state’s equity in the LNG project, large unfunded

superannuation liabilities, and contingent liabilities surrounding the

successful completion of the LNG project. Progressively reducing these

state liabilities will be important to taming fiscal risks.

In the medium-term, the outlook for growth remains strong and

for public debt to remain low. While government plans to increase

investment in critical national infrastructure and social services are

commendable, this priority must be balanced against its need to maintain

fiscal buffers against future shocks. Building up the country’s economic

resilience will be vital to avoiding reprising past boom–bust cycles.

Sources: PNG Department of Treasury. 2012. 2013 National Budget. December; ADB estimates

Source

http://www.t...ry.gov.pg/Category

EconomyGet a Quote