Credit and Home Ownership

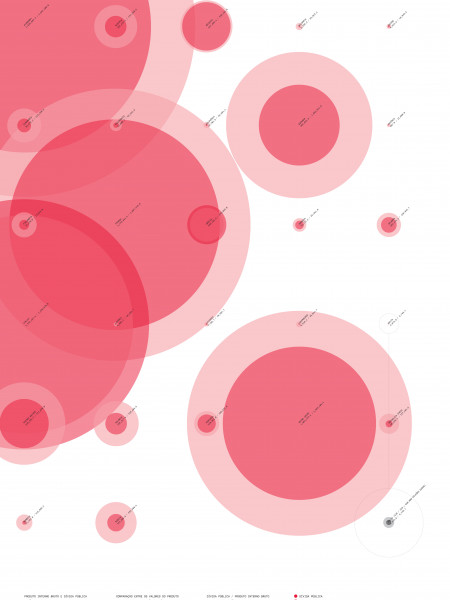

CRISIS CREDIT PART 1: FROM HOMEOWNER TO INVESTOR THE of SAFE 4% OKAY 72 VISUALIZED RISKY 10% BUYING A HOUSE INSIDE A CDO This makes the bottom tray riskier, and the top tray safer. A family like us wants a house, so we contact a MORTGAGE LENDER, who lends us a MORTGAGE loan. The banker then slices the box into three slices, or TRANCHES. The tranches work like 3 cascading trays. To compensate for the higher risk, the owner of the bottom We buy a house and become HOMEOWNERS! This is great for us because housing prices have been rising practically forever. 2 SELLING THE MORTGAGE tray receives a higher rate of return, and the top tray receives a lower (but still nice) return. PENSION FUNDS INSURANCE COMPANIES As money from mortgage payments comes in, the top tray fills up first, then spills over into the middle, then finally into the bottom. SOVEREIGN FUNDS MUTUAL FUNDS The lender gets a call from an INVESTMENT BANKER to buy his mortgage - a nice payday for the lender. Along with the mortgage, the lender has also sold his risk. Were the homeowner to default, it is now the banker's problem. ETC The lender profits from fees and interest payments. If some homeowners default on their mortgages, less money comes in, and the bottom tray may not get filled. HOMEOWNERS MORTGAGE INVESTMENT BANKER INVESTORS LENDER SAFE x 1000s OKAY CDO BANKERS MORTGAGE RISKY COLLATERALIZED DEBT OBLIGATION TRANCHES HEDGE FUNDS 6. TRANSFORMING 5. INVESTING IN MORTGAGES THE MORTGAGE The INVESTORS, representing billions in managed money, buy the top tranche because it meets their low-risk profile. dollars The banker borrows millions of dollars and buys thousands more mortgages and puts them into a nice big box. MAKING IT "SAFE" AAA The banker splits the CDO this way so that CREDIT RATING AGENCIES will rate the top tranche with the safest rating: AAA. Other banks buy the middle tranche. This means that every month, the banker gets the monthly payment from all of the mortgage holders in the box, like me. BBB Hedge fund managers, other speculators and risk takers, like me, buy the bottom tranche. The middle tranche is rated BBB (still pretty good). We now assume the risk if the homeowners default. This box is called a COLLATERALIZED DEBT OBLIGATION, or CDO. UNRATED And they don't bother to rate the bottom, risky slice. PART 2 00 MORE INFO Duis dolortiolbh et ad tiniatum Duis dolortiolbh et ad tiniatum erostin do- AMY Duis dolortiolbh et ad tiniatum erostin MORE INFO Duis dolortiolbh et ad tiniatum Duis dolortiolbh et ad tiniatum erostin do- AMY Duis dolortiolbh et ad tiniatum erostin 00 GOOD Jul/Aug 07 dolortin hendit nim zzrit, con erostin vel- lortin hendit nim zzrit, con erostin veliquipit, dolortin hendit nim zzrit, con erostin vel- dolortin hendit nim zzrit, con erostin vel- lortin hendit nim zzrit, con erostin veliquipit, dolortin hendit nim zzrit, con erostin vel- goodmagazine.com Transparency iquipit, senim nos et, quat. senim nos et, quat. iquipit, senim nos et, quat. iquipit, senim nos et, quat. senim nos et, quat. iquipit, senim nos et, quat. Transparency

Credit and Home Ownership

Source

Unknown. Add a sourceCategory

EconomyGet a Quote