Is America Ready for the Largest Intergenerational Transfer of Wealth in History?

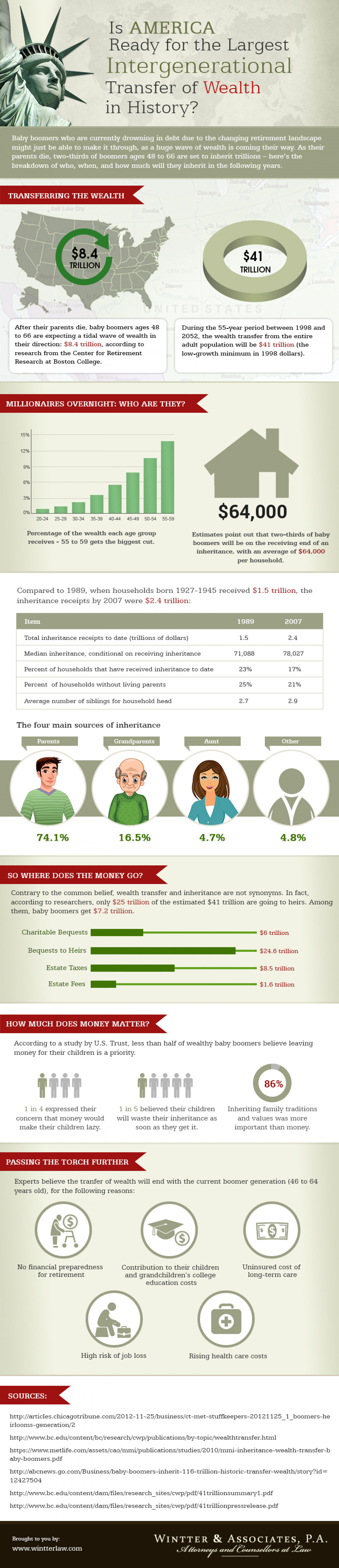

Is AMERICA Ready for the Largest Intergenerational Transfer of Wealth in History? Baby boomers who are currently drowning in debt due to the changing retirement landscape might just be able to make it through, as a huge wave of wealth is coming their way. As their parents die, two-thirds of boomers ages 48 to 66 are set to inherit trillions – here's the breakdown of who, when, and how much will they inherit in the following years. Datroit Clevaland (Philade Chicago Lake Erie TRANSFERRING THE WEALTH *Washingto t Lake City Omaha Norfolk St. Lo troit Vega $8.4 $41 erie TRILLION TRILLION Louisville Danver UNITED STATES After their parents die, baby boomers ages 48 to 66 are expecting a tidal wave of wealth in During the 55-year period between 1998 and 2052, the wealth transfer from the entire their direction: $8.4 trillion, according to adult population will be $41 trillion (the low-growth minimum in 1998 dollars). research from the Center for Retirement Research at Boston College. THouston, MILLIONAIRES OVERNIGHT: WHO ARE THEY? 15% 12% 9% 6% 3% $64,000 0% 20-24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 Percentage of the wealth each age group receives - 55 to 59 gets the biggest cut. Estimates point out that two-thirds of baby boomers will be on the receiving end of an inheritance, with an average of $64,000 per household. Compared to 1989, when households born 1927-1945 received $1.5 trillion, the inheritance receipts by 2007 were $2.4 trillion: Item 1989 2007 Total inheritance receipts to date (trillions of dollars) 1.5 2.4 Median inheritance, conditional on receiving inheritance 71,088 78,027 Percent of households that have received inheritance to date 23% 17% Percent of households without living parents 25% 21% Average number of siblings for household head 2.7 2.9 The four main sources of inheritance Parents Grandparents Aunt Other 74.1% 16.5% 4.7% 4.8% SO WHERE DOES THE MONEY GO? Contrary to the common belief, wealth transfer and inheritance are not synonyms. In fact, according to researchers, only $25 trillion of the estimated $41 trillion are going to heirs. Among them, baby boomers get $7.2 trillion. Charitable Bequests $6 trillion Bequests to Heirs $24.6 trillion Estate Taxes $8.5 trillion Estate Fees $1.6 trillion HOW MUCH DOES MONEY MATTER? According to a study by U.S. Trust, less than half of wealthy baby boomers believe leaving money for their children is a priority. 86% 1 in 4 expressed their 1 in 5 believed their children Inheriting family traditions concern that money would make their children lazy. will waste their inheritance as and values was more soon as they get it. important than money. PASSING THE TORCH FURTHER Experts believe the tranfer of wealth will end with the current boomer generation (46 to 64 years old), for the following reasons: No financial preparedness for retirement Uninsured cost of long-term care Contribution to their children and grandchildren's college education costs High risk of job loss Rising health care costs SOURCES: http://articles.chicagotribune.com/2012-11-25/business/ct-met-stuffkeepers-20121125_1_boomers-he irlooms-generation/2 http://www.bc.edu/content/bc/research/cwp/publications/by-topic/wealthtransfer.html https://www.metlife.com/assets/cao/mmi/publications/studies/2010/mmi-inheritance-wealth-transfer-b aby-boomers.pdf http://abcnews.go.com/Business/baby-boomers-inherit-116-trillion-historic-transfer-wealth/story?id= 12427504 http://www.bc.edu/content/dam/files/research_sites/cwp/pdf/41trillionsummary1.pdf http://www.bc.edu/content/dam/files/research_sites/cwp/pdf/41trillionpressrelease.pdf WINTTER & ASSOCIATES, P.A. Attorneys and Counsellors at Law Brought to you by: wWw.wintterlaw.com

Is America Ready for the Largest Intergenerational Transfer of Wealth in History?

Source

http://www.w...h-history/Category

EconomyGet a Quote