Volatility Trading

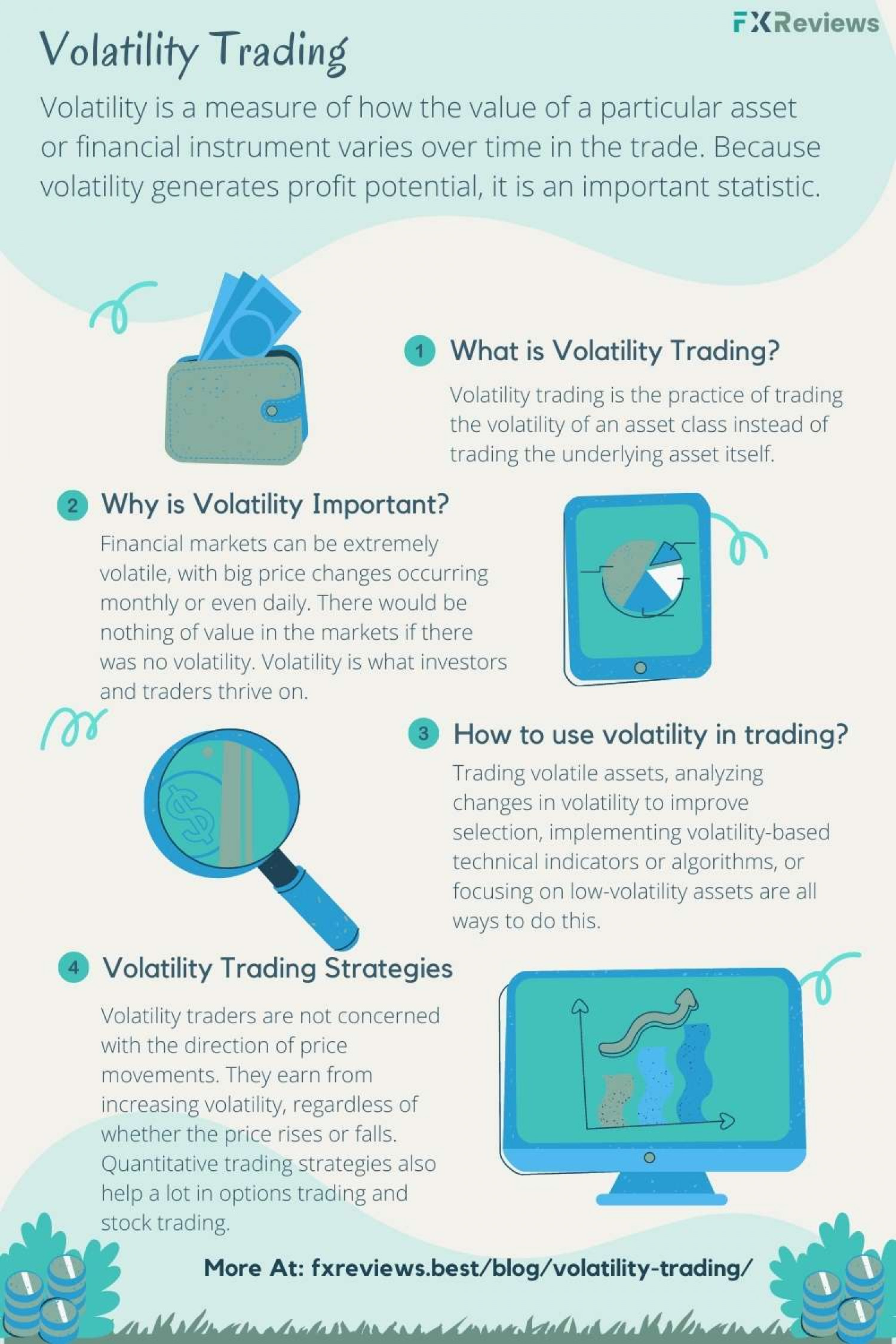

Volatility Trading Volatility is a measure of how the value of a particular asset or financial instrument varies over time in the trade . Because volatility generates profit potential , it is an important statistic . What is Volatility Trading ? Volatility trading is the practice of trading the volatility of an asset class instead of trading the underlying asset itself . 2 Why is Volatility Important ? Financial markets can be extremely volatile , with big price changes occurring monthly or even daily . There would be nothing of value in the markets if there was no volatility . Volatility is what investors and traders thrive on . m FXReviews 3 How to use volatility in trading ? Trading volatile assets , analyzing changes in volatility to improve selection , implementing volatility - based technical indicators or algorithms , or focusing on low - volatility assets are all ways to do this . 4 Volatility Trading Strategies Volatility traders are not concerned with the direction of price movements . They earn from increasing volatility , regardless of whether the price rises or falls . Quantitative trading strategies also help a lot in options trading and stock trading . More At : fxreviews.best/blog/volatility-trading/ MMM

Volatility Trading

Source

https://fxre...y-trading/Category

BusinessGet a Quote