Intercompany Netting

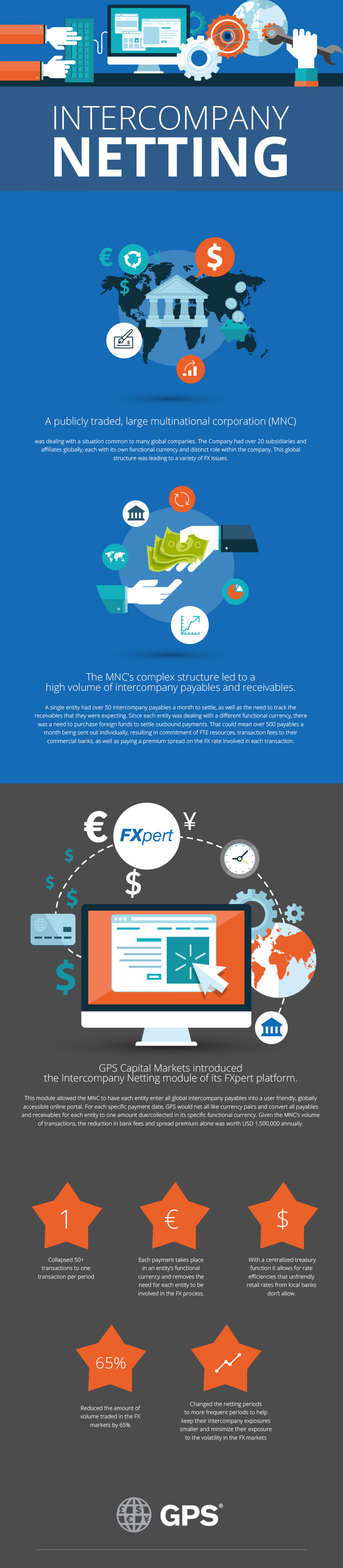

INTERCOMPANY NETTING 24 A publicly traded, large multinational corporation (MNC) was dealing with a situation common to many global companies. The Company had over 20 subsidiaries and affiliates globally, each with its own functional currency and distinct role within the company. This global structure was leading to a variety of FX issues. ш The MNC's complex structure led to a high volume of intercompany payables and receivables. A single entity had over 50 intercompany payables a month to settle, as well as the need to track the receivables that they were expecting. Since each entity was dealing with a different functional currency, there was a need to purchase foreign funds to settle outbound payments. That could mea month being sent out individually, resulting in commitment of FTE resources, transaction fees to their over 500 payables a commercial banks, as well as paying a premium spread on the FX rate involved in each transaction. FXpert 2$ %24 GPS Capital Markets introduced the Intercompany Netting module of its FXpert platform. This module allowed the MNC to have each entity enter all global intercompany payables into a user friendly, globally accessible online portal. For each specific payment date, GPS would net all like currency pairs and convert all payables and receivables for each entity to one amount due/collected in its specific functional currency. Given the MNC's volume of transactions, the reduction in bank fees and spread premium alone was worth USD 1,500,000 annually. 1 € Each payment takes place in an entity's functional With a centralized treasury function it allows for rate efficiencies that unfriendly Collapsed 50+ transactions to one transaction per period currency and removes the need for each entity to be retail rates from local banks involved in the FX process. don't allow. 65% Changed the netting periods to more frequent periods to help keep their intercompany exposures smaller and minimize their exposure Reduced the amount of volume traded in the FX markets by 65% to the volatility in the FX markets GPS %24 %24

Intercompany Netting

Source

http://gpsca...rkets.com/Category

BusinessGet a Quote