The History of Banking

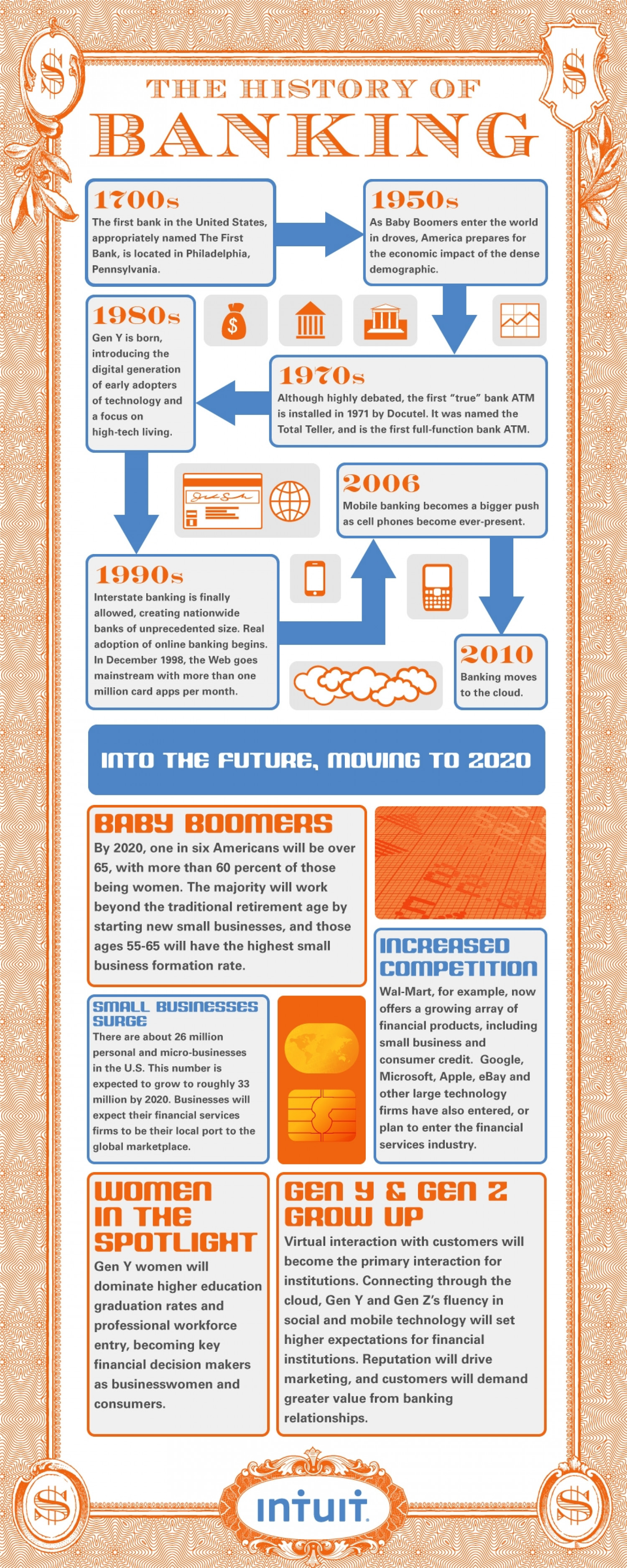

THE HISTORY OF BANKING 1700s 1950s As Baby Boomers enter the world in droves, America prepares for The first bank in the United States, appropriately named The First Bank, is located in Philadelphia, the economic impact of the dense Pennsylvania. demographic. 1980s S Gen Y is born, introducing the digital generation of early adopters 1970s Although highly debated, the first "true" bank ATM is installed in 1971 by Docutel. It was named the of technology and a focus on high-tech living. Total Teller, and is the first full-function bank ATM. 2006 Mobile banking becomes a bigger push as cell phones become ever-present. 1990s Interstate banking is finally allowed, creating nationwide banks of unprecedented size. Real adoption of online banking begins. |2010 In December 1998, the Web goes mainstream with more than one Banking moves million card apps per month. to the cloud. INTO THE FUTURE, MOOUING TO 2020 BABY BOO MERS By 2020, one in six Americans will be over 65, with more than 60 percent of those being women. The majority will work beyond the traditional retirement age by starting new small businesses, and those INCREASED COMPETITION ages 55-65 will have the highest small business formation rate. Wal-Mart, for example, now SMALL BUSINESSES SURGE offers a growing array of financial products, including small business and There are about 26 million personal and micro-businesses consumer credit. Google, Microsoft, Apple, eBay and in the U.S. This number is expected to grow to roughly 33 other large technology million by 2020. Businesses will firms have also entered, or expect their financial services plan to enter the financial services industry. firms to be their local port to the global marketplace. WOMEN IN THE SPOTLIGHT GEN Y & GEN 2 GROW UP Virtual interaction with customers will Gen Y women will become the primary interaction for dominate higher education institutions. Connecting through the cloud, Gen Y and Gen Z's fluency in social and mobile technology will set graduation rates and professional workforce entry, becoming key higher expectations for financial financial decision makers institutions. Reputation will drive as businesswomen and marketing, and customers will demand greater value from banking relationships. consumers. intuit. THE HISTORY OF BANKING 1700s 1950s As Baby Boomers enter the world in droves, America prepares for The first bank in the United States, appropriately named The First Bank, is located in Philadelphia, the economic impact of the dense Pennsylvania. demographic. 1980s S Gen Y is born, introducing the digital generation of early adopters 1970s Although highly debated, the first "true" bank ATM is installed in 1971 by Docutel. It was named the of technology and a focus on high-tech living. Total Teller, and is the first full-function bank ATM. 2006 Mobile banking becomes a bigger push as cell phones become ever-present. 1990s Interstate banking is finally allowed, creating nationwide banks of unprecedented size. Real adoption of online banking begins. |2010 In December 1998, the Web goes mainstream with more than one Banking moves million card apps per month. to the cloud. INTO THE FUTURE, MOOUING TO 2020 BABY BOO MERS By 2020, one in six Americans will be over 65, with more than 60 percent of those being women. The majority will work beyond the traditional retirement age by starting new small businesses, and those INCREASED COMPETITION ages 55-65 will have the highest small business formation rate. Wal-Mart, for example, now SMALL BUSINESSES SURGE offers a growing array of financial products, including small business and There are about 26 million personal and micro-businesses consumer credit. Google, Microsoft, Apple, eBay and in the U.S. This number is expected to grow to roughly 33 other large technology million by 2020. Businesses will firms have also entered, or expect their financial services plan to enter the financial services industry. firms to be their local port to the global marketplace. WOMEN IN THE SPOTLIGHT GEN Y & GEN 2 GROW UP Virtual interaction with customers will Gen Y women will become the primary interaction for dominate higher education institutions. Connecting through the cloud, Gen Y and Gen Z's fluency in social and mobile technology will set graduation rates and professional workforce entry, becoming key higher expectations for financial financial decision makers institutions. Reputation will drive as businesswomen and marketing, and customers will demand greater value from banking relationships. consumers. intuit. THE HISTORY OF BANKING 1700s 1950s As Baby Boomers enter the world in droves, America prepares for The first bank in the United States, appropriately named The First Bank, is located in Philadelphia, the economic impact of the dense Pennsylvania. demographic. 1980s S Gen Y is born, introducing the digital generation of early adopters 1970s Although highly debated, the first "true" bank ATM is installed in 1971 by Docutel. It was named the of technology and a focus on high-tech living. Total Teller, and is the first full-function bank ATM. 2006 Mobile banking becomes a bigger push as cell phones become ever-present. 1990s Interstate banking is finally allowed, creating nationwide banks of unprecedented size. Real adoption of online banking begins. |2010 In December 1998, the Web goes mainstream with more than one Banking moves million card apps per month. to the cloud. INTO THE FUTURE, MOOUING TO 2020 BABY BOO MERS By 2020, one in six Americans will be over 65, with more than 60 percent of those being women. The majority will work beyond the traditional retirement age by starting new small businesses, and those INCREASED COMPETITION ages 55-65 will have the highest small business formation rate. Wal-Mart, for example, now SMALL BUSINESSES SURGE offers a growing array of financial products, including small business and There are about 26 million personal and micro-businesses consumer credit. Google, Microsoft, Apple, eBay and in the U.S. This number is expected to grow to roughly 33 other large technology million by 2020. Businesses will firms have also entered, or expect their financial services plan to enter the financial services industry. firms to be their local port to the global marketplace. WOMEN IN THE SPOTLIGHT GEN Y & GEN 2 GROW UP Virtual interaction with customers will Gen Y women will become the primary interaction for dominate higher education institutions. Connecting through the cloud, Gen Y and Gen Z's fluency in social and mobile technology will set graduation rates and professional workforce entry, becoming key higher expectations for financial financial decision makers institutions. Reputation will drive as businesswomen and marketing, and customers will demand greater value from banking relationships. consumers. intuit. THE HISTORY OF BANKING 1700s 1950s As Baby Boomers enter the world in droves, America prepares for The first bank in the United States, appropriately named The First Bank, is located in Philadelphia, the economic impact of the dense Pennsylvania. demographic. 1980s S Gen Y is born, introducing the digital generation of early adopters 1970s Although highly debated, the first "true" bank ATM is installed in 1971 by Docutel. It was named the of technology and a focus on high-tech living. Total Teller, and is the first full-function bank ATM. 2006 Mobile banking becomes a bigger push as cell phones become ever-present. 1990s Interstate banking is finally allowed, creating nationwide banks of unprecedented size. Real adoption of online banking begins. |2010 In December 1998, the Web goes mainstream with more than one Banking moves million card apps per month. to the cloud. INTO THE FUTURE, MOOUING TO 2020 BABY BOO MERS By 2020, one in six Americans will be over 65, with more than 60 percent of those being women. The majority will work beyond the traditional retirement age by starting new small businesses, and those INCREASED COMPETITION ages 55-65 will have the highest small business formation rate. Wal-Mart, for example, now SMALL BUSINESSES SURGE offers a growing array of financial products, including small business and There are about 26 million personal and micro-businesses consumer credit. Google, Microsoft, Apple, eBay and in the U.S. This number is expected to grow to roughly 33 other large technology million by 2020. Businesses will firms have also entered, or expect their financial services plan to enter the financial services industry. firms to be their local port to the global marketplace. WOMEN IN THE SPOTLIGHT GEN Y & GEN 2 GROW UP Virtual interaction with customers will Gen Y women will become the primary interaction for dominate higher education institutions. Connecting through the cloud, Gen Y and Gen Z's fluency in social and mobile technology will set graduation rates and professional workforce entry, becoming key higher expectations for financial financial decision makers institutions. Reputation will drive as businesswomen and marketing, and customers will demand greater value from banking relationships. consumers. intuit. THE HISTORY OF BANKING 1700s 1950s As Baby Boomers enter the world in droves, America prepares for The first bank in the United States, appropriately named The First Bank, is located in Philadelphia, the economic impact of the dense Pennsylvania. demographic. 1980s S Gen Y is born, introducing the digital generation of early adopters 1970s Although highly debated, the first "true" bank ATM is installed in 1971 by Docutel. It was named the of technology and a focus on high-tech living. Total Teller, and is the first full-function bank ATM. 2006 Mobile banking becomes a bigger push as cell phones become ever-present. 1990s Interstate banking is finally allowed, creating nationwide banks of unprecedented size. Real adoption of online banking begins. |2010 In December 1998, the Web goes mainstream with more than one Banking moves million card apps per month. to the cloud. INTO THE FUTURE, MOOUING TO 2020 BABY BOO MERS By 2020, one in six Americans will be over 65, with more than 60 percent of those being women. The majority will work beyond the traditional retirement age by starting new small businesses, and those INCREASED COMPETITION ages 55-65 will have the highest small business formation rate. Wal-Mart, for example, now SMALL BUSINESSES SURGE offers a growing array of financial products, including small business and There are about 26 million personal and micro-businesses consumer credit. Google, Microsoft, Apple, eBay and in the U.S. This number is expected to grow to roughly 33 other large technology million by 2020. Businesses will firms have also entered, or expect their financial services plan to enter the financial services industry. firms to be their local port to the global marketplace. WOMEN IN THE SPOTLIGHT GEN Y & GEN 2 GROW UP Virtual interaction with customers will Gen Y women will become the primary interaction for dominate higher education institutions. Connecting through the cloud, Gen Y and Gen Z's fluency in social and mobile technology will set graduation rates and professional workforce entry, becoming key higher expectations for financial financial decision makers institutions. Reputation will drive as businesswomen and marketing, and customers will demand greater value from banking relationships. consumers. intuit. THE HISTORY OF BANKING 1700s 1950s As Baby Boomers enter the world in droves, America prepares for The first bank in the United States, appropriately named The First Bank, is located in Philadelphia, the economic impact of the dense Pennsylvania. demographic. 1980s S Gen Y is born, introducing the digital generation of early adopters 1970s Although highly debated, the first "true" bank ATM is installed in 1971 by Docutel. It was named the of technology and a focus on high-tech living. Total Teller, and is the first full-function bank ATM. 2006 Mobile banking becomes a bigger push as cell phones become ever-present. 1990s Interstate banking is finally allowed, creating nationwide banks of unprecedented size. Real adoption of online banking begins. |2010 In December 1998, the Web goes mainstream with more than one Banking moves million card apps per month. to the cloud. INTO THE FUTURE, MOOUING TO 2020 BABY BOO MERS By 2020, one in six Americans will be over 65, with more than 60 percent of those being women. The majority will work beyond the traditional retirement age by starting new small businesses, and those INCREASED COMPETITION ages 55-65 will have the highest small business formation rate. Wal-Mart, for example, now SMALL BUSINESSES SURGE offers a growing array of financial products, including small business and There are about 26 million personal and micro-businesses consumer credit. Google, Microsoft, Apple, eBay and in the U.S. This number is expected to grow to roughly 33 other large technology million by 2020. Businesses will firms have also entered, or expect their financial services plan to enter the financial services industry. firms to be their local port to the global marketplace. WOMEN IN THE SPOTLIGHT GEN Y & GEN 2 GROW UP Virtual interaction with customers will Gen Y women will become the primary interaction for dominate higher education institutions. Connecting through the cloud, Gen Y and Gen Z's fluency in social and mobile technology will set graduation rates and professional workforce entry, becoming key higher expectations for financial financial decision makers institutions. Reputation will drive as businesswomen and marketing, and customers will demand greater value from banking relationships. consumers. intuit.

The History of Banking

Designer

IntuitSource

Unknown. Add a sourceCategory

BusinessGet a Quote