The Growth in Alternative & Complementary Finance

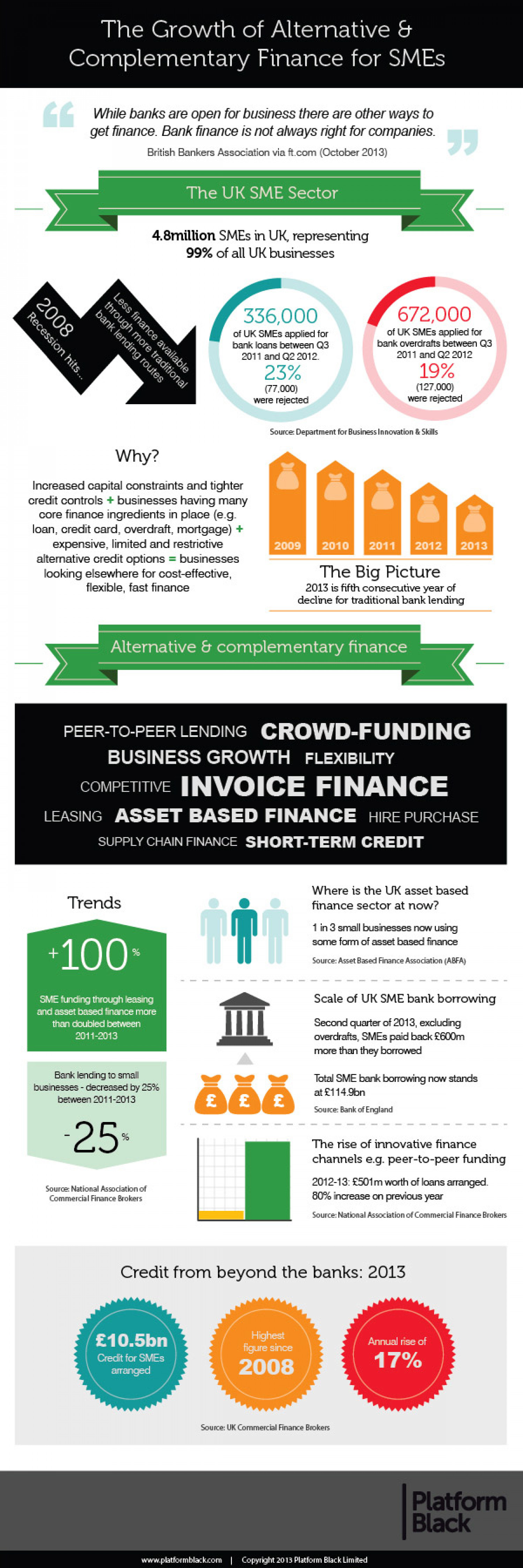

The Growth of Alternative & Complementary Finance for SMES G While banks are open for business there are other ways to get finance. Bank finance is not always right for companies. British Bankers Association via ft.com (October 2013) The UK SME Sector 4.8million SMES in UK, representing 99% of all UK businesses 336,000 672,000 of UK SMES applied for bank loans between Q3 2011 and Q2 2012. of UK SMES applied for bank overdrafts between Q3 2011 and Q2 2012 19% 23% (77,000) were rejected (127,000) were rejected Source: Department rBusiness Innovation & Skills Why? Increased capital constraints and tighter credit controls + businesses having many core finance ingredients in place (e.g. loan, credit card, overdraft, mortgage) + expensive, limited and restrictive alternative credit options = businesses looking elsewhere for cost-effective, flexible, fast finance 2009 2010 2011 2012 2013 The Big Picture 2013 is fifth consecutive year of decline for traditional bank lending Alternative & complementary finance PEER-TO-PEER LENDING CROWD-FUNDING BUSINESS GROWTH FLEXIBILITY COMPETITIVE INVOICE FINANCE LEASING ASSET BASED FINANCE HIRE PURCHASE SUPPLY CHAIN FINANCE SHORT-TERM CREDIT Where is the UK asset based Trends finance sector at now? 1 in 3 small businesses now using +100 same farm of asset based finance Source: Asset Based Finance Association (ABFA) Scale of UK SME bank borrowing SME funding through leasing and asset based finance more than doubled between 2011-2013 III Second quarter of 2013, excluding overdrafts, SMES paid back £600m more than they borrowed Bank lending to small businesses - decreased by 25% between 2011-2013 Total SME bank borrowing now stands at £114.9bn Source: Bank of England 25. The rise of innovative finance channels e.g. peer-to-peer funding 2012-13: £501m worth of loans arranged. 80% increase on previous year Source: National Association of Commercial Finance Brokers Source: National Association of Commercial Finance Brokers Credit from beyond the banks: 2013 £10.5bn Highest figure since Annual rise of Credit for SMES arranged 2008 17% Source: UK Commercial Finance Brokers Platform Black www.platformblackcom | Copyright 2013 Platform Black Limited through m Less finance a bank 200on hits.

The Growth in Alternative & Complementary Finance

Source

http://www.p...mblack.comCategory

BusinessGet a Quote