Wage Slipping: How Does the Government Spend Your Income Tax and National Insurance?

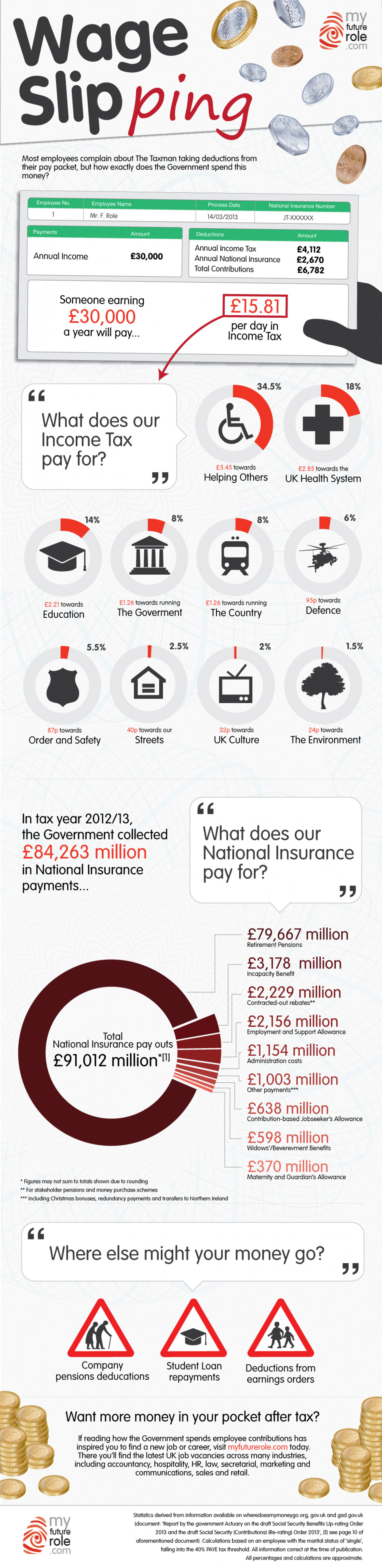

Wage Slipping my future role .com Most employees complain about The Taxman taking deductions from their pay packet, but how exactly does the Government spend this money? Employee No. Employee Name Process Date National Insurance Number Mr. F. Role 14/03/2013 JT-XXXXXX Payments Amount Deductions Amount Annual Income Tax £4,112 £2,670 £6,782 Annual Income £30,000 Annual National Insurance Total Contributions Someone earning £15.81 £30,000 a year will pay... per day in Income Tax 34.5% 18% What does our Income Tax pay for? £5.45 towards £2.85 towards the Helping Others UK Health System 14% 8% 8% 6% £1.26 towards running £1.26 towards running 95p towards £2.21 towards Education The Goverment The Country Defence 5.5% 2.5% 2% 1.5% 87p towards 40p towards our 32p towards 24p towards Order and Safety Streets UK Culture The Environment In tax year 2012/13, the Government collected What does our National Insurance £84,263 million in National Insurance payments.. pay for? リリ £79,667 million Retirement Pensions £3,178 million Incapacity Benefit £2,229 million Contracted-out rebates** £2,156 million Employment and Support Allowance Total National Insurance pay outs £1,154 million £91,012 million" Administration costs £1,003 million Other payments*** £638 million Contribution-based Jobseeker's Allowance £598 million Widows'/Beverevment Benefits £370 million Maternity and Guardian's Allowance * Figures may not sum to totals shown due to rounding ** For stakeholder pensions and money purchase schemes *** including Christmas bonuses, redundancy payments and transfers to Northern Ireland Where else might your money go? リラ Company pensions deducations Student Loan Deductions from repayments earnings orders Want more money in your pocket after tax? If reading how the Government spends employee contributions has inspired you to find a new job or career, visit myfuturerole.com today. There you'll find the latest UK job vacancies across many industries, including accountancy, hospitality, HR, law, secretarial, marketing and communications, sales and retail. Statistics derived from information available on wheredoesmymoneygo.org, gov.uk and gad.gov.uk my future (document: "Report by the government Actuary on the draft Social Security Benefits Up-rating Order 2013 and the draft Social Security (Contributions) (Re-rating) Order 2013', 1) see page 10 of role aforementioned document). Calculations based on an employee with the marital status of 'single', .com falling into the 40% PAYE tax threshold. All information correct at the time of publication. All percentages and calculations are approximate.

Wage Slipping: How Does the Government Spend Your Income Tax and National Insurance?

Source

http://blog....-insuranceCategory

PoliticsGet a Quote