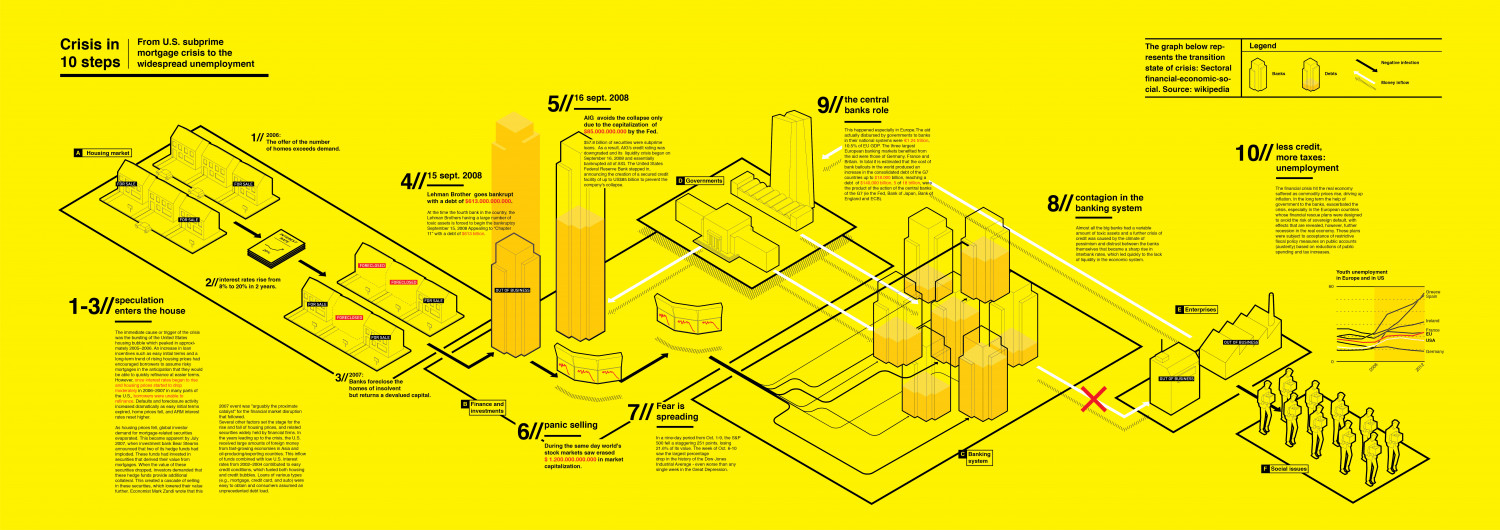

The subprime crisis in 10 steps

From U.S. subprime mortgage crisis to the 10 steps | widespread unemployment Crisis in The graph below rep- Legend resents the transition Negative infection state of crisis: Sectoral Banks Debts financial-economic-so- Money inflow cial. Source: wikipedia '16 sept. 2008 9//ne the central banks role AIG avoids the collapse only due to the capitalization of $85.000.000.000 by the Fed. This happened especially in Europe.The aid actually disbursed by governments to banks in their national systems were €1.24 trillion, 10.5% of EU GDP. The three largest European banking markets benefited from the aid were those of Germany, France and Britain. In total it is estimated that the cost of 1// 2006: The offer of the number $57.8 billion of securities were subprime loans. As a result, AIG's credit rating was downgraded and its liquidity crisis began on September 16, 2008 and essentially bankrupted all of AIG. The United States Federal Reserve Bank stepped in, less credit, 10// more taxes: of homes exceeds demand. A Housing market ////I. unemployment bank bailouts in the world produced an increase in the consolidated debt of the G7 countries up to $18.000 billion, reaching a debt of $140,000 billion. 5 of 18 trillion, were the product of the action of the central banks of the G7 (ie the Fed, Bank of Japan, Bank of England and ECB). 4//'5 '15 sept. 2008 announcing the creation of a secured credit facility of up to US$85 billion to prevent the company's collapse. D Governments FOR SALE FOR SALE The financial crisis hit the real economy suffered as commodity prices rise, driving up inflation. In the long term the help of government to the banks, exacerbated the crisis, especially in the European countries whose financial rescue plans were designed to avoid the risk of sovereign default, with effects that are revealed, however, further recession in the real economy. These plans were subject to acceptance of restrictive fiscal policy measures on public accounts (austerity) based on reductions of public spending and tax increases. Lehman Brother goes bankrupt with a debt of $613.000.000.000. 8// contagion in the banking system At the time the fourth bank in the country, the Lehman Brothers having a large number of toxic assets is forced to begin the bankruptcy FOR SALE September 15, 2008 Appealing to “Chapter 11" with a debt of $613 billion. Almost all the big banks had a variable amount of toxic assets and a further crisis of credit was caused by the climate of INTEREST RATE pessimism and distrust between the banks themselves that became a sharp rise in interbank rates, which led quickly to the lack of liquidity in the economic system. 20% FORECLOSED Youth unemployment in Europe and in US 2//interest rates rise from 8% to 20% in 2 years. FORECLOSED 60 OUT OF BUSINESS Greece Spain speculation 1-3// enters the house FOR SALE FOR SALE E Enterprises FORECLOSED Ireland The immediate cause or trigger of the crisis France EU was the bursting of the United States housing bubble which peaked in approxi- mately 2005–2006. An increase in loan FOR SALE OUT OF BUSINESS USA Germany incentives such as easy initial terms and a long-term trend of rising housing prices had encouraged borrowers to assume risky mortgages in the anticipation that they would be able to quickly refinance at easier terms. However, once interest rates began to rise and housing prices started to drop moderately in 2006–2007 in many parts of the U.S., borrowers were unable to refinance. Defaults and foreclosure activity increased dramatically as easy initial terms expired, home prices fell, and ARM interest rates reset higher. 2012 3//2007: Banks foreclose the OUT OF BUSINESS homes of insolvent but returns a devalued capital. B Finance and investments Fear is 7II spreading 7// 2007 event was "arguably the proximate catalyst" for the financial market disruption that followed. Several other factors set the stage for the rise and fall of housing prices, and related securities widely held by financial firms. In the years leading up to the crisis, the U.S. received large amounts of foreign money from fast-growing economies in Asia and oil-producing/exporting countries. This inflow of funds combined with low U.S. interest 7panic selling 6//° As housing prices fell, global investor demand for mortgage-related securities evaporated. This became apparent by July 2007, when investment bank Bear Stearns announced that two of its hedge funds had imploded. These funds had invested in securities that derived their value from mortgages. When the value of these securities dropped, investors demanded that these hedge funds provide additional collateral. This created a cascade of selling in these securities, which lowered their value further. Economist Mark Zandi wrote that this In a nine-day period from Oct. 1-9, the S&P 500 fell a staggering 251 points, losing 21.6% of its value. The week of Oct. 6-10 saw the largest percentage drop in the history of the Dow Jones Industrial Average even worse than any single week in the Great Depression. During the same day world's stock markets saw erased $ 1.200.000.000.000 in market capitalization. C Banking system rates from 2002-2004 contributed to easy F Social issues credit conditions, which fueled both housing and credit bubbles. Loans of various types (e.g., mortgage, credit card, and auto) were easy to obtain and consumers assumed an unprecedented debt load. 2008

The subprime crisis in 10 steps

Source

https://www....lustrated-Category

EconomyGet a Quote