Home Depot (HD) Valuation Sheet

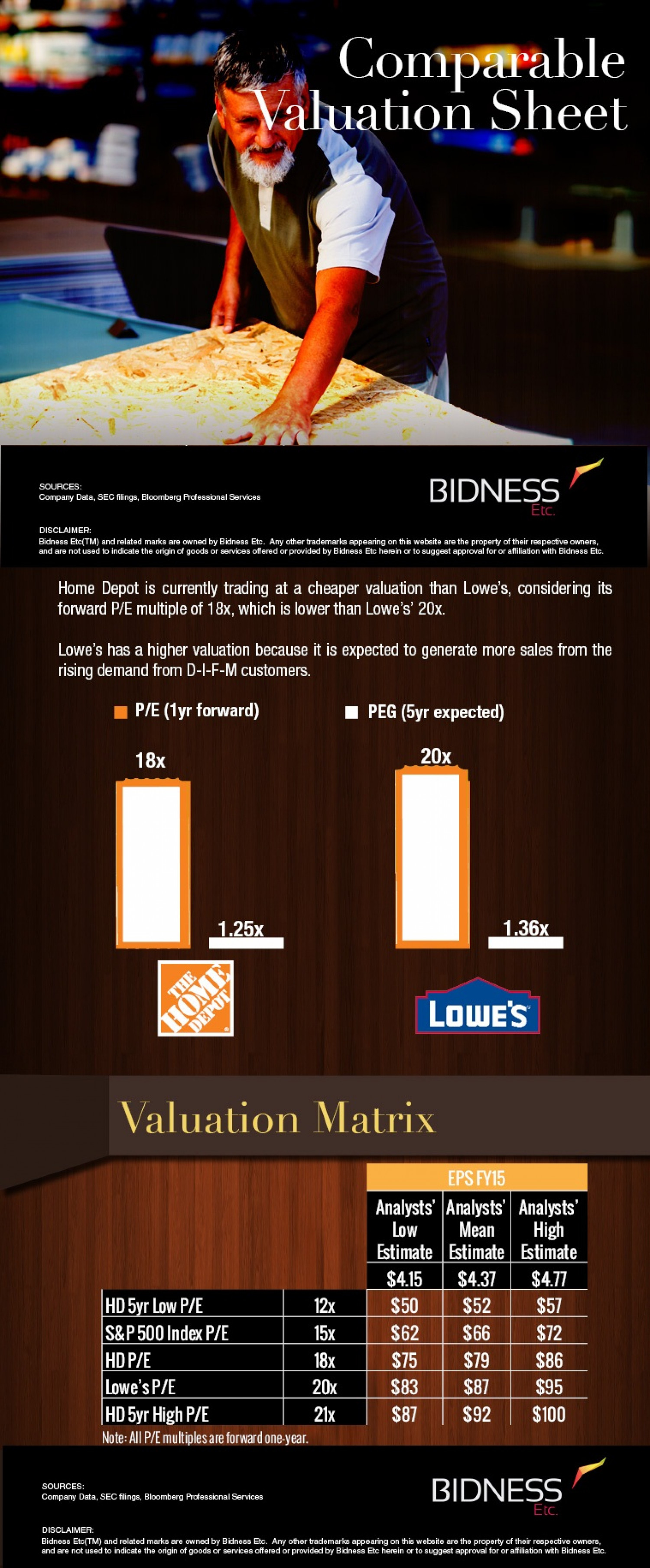

Comparable Valuation Sheet BIDNESS SOURCES: Company Data, SEC filings, Bloomberg Professional Services Etc. DISCLAIMER: Bidness Etc(TM) and related marks are owned by Bidness Etc. Any other trademarks appearing on this website are the property of their respective owners, and are not used to indicate the origin of goods or services offered or provided by Bidness Etc herein or to suggest approval for or affiliation with Bidness Etc. Home Depot is currently trading at a cheaper valuation than Lowe's, considering its forward P/E multiple of 18x, which is lower than Lowe's' 20x. Lowe's has a higher valuation because it is expected to generate more sales from the rising demand from D-I-F-M customers. I P/E (1yr forward) I PEG (5yr expected) 18x 20x 1.25x 1.36x HOME DEPOT LOWE'S Valuation Matrix EPS FY15 Analysts' Analysts' Analysts' Low Estimate Estimate Estimate Mean High $4.15 $4.37 $4.77 HD 5yr Low P/E S&P500 Index P/E HD P/E Lowe's P/E |HD 5yr High P/E 12x $50 $52 $57 15x $62 $66 $72 $75 $83 18x $79 $86 20x $87 $95 21x $87 $92 $100 Note: All P/E multiples are forward one-year. BIDNESS SOURCES: Company Data, SEC filings, Bloomberg Professional Services Etc. DISCLAIMER: Bidness Etc(TM) and related marks are owned by Bidness Etc. Any other trademarks appearing on this website are the property of their respective owners, and are not used to indicate the origin of goods or services offered or provided by Bidness Etc herein or to suggest approval for or affiliation with Bidness Etc.

Home Depot (HD) Valuation Sheet

Source

http://www.b...ion-sheet/Category

BusinessGet a Quote