Debit Cards, The Durbin Amendment, And You

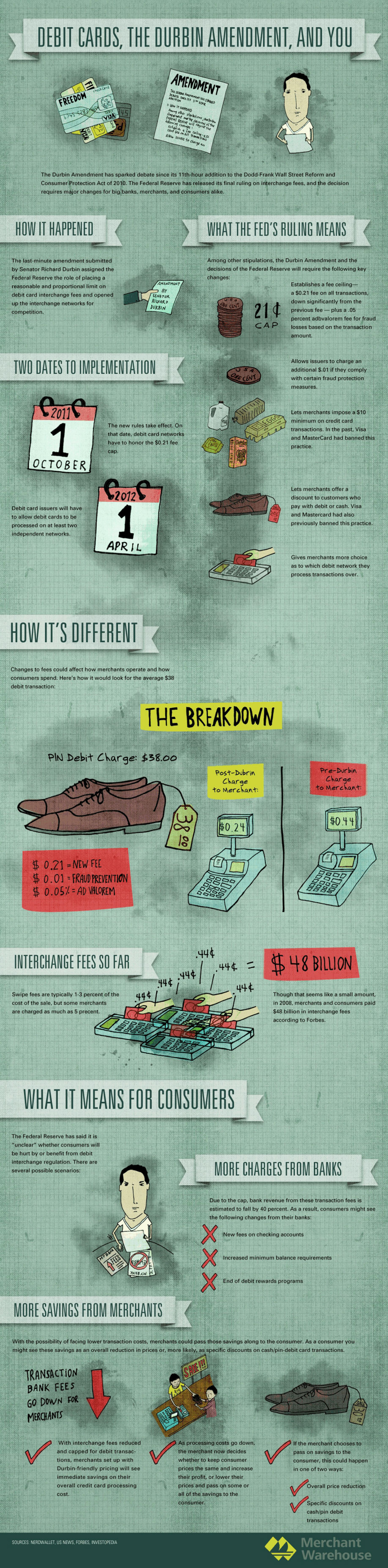

DEBIT CARDS, THE DURBIN AMENDMENT, AND YOU AMENDMENT check Card Apition FREEDOM Aang oher sierations eb Aretnt and te daons of the fedeal Rseve will reuite the lolomig chans 745-5287 Sh VGIA) CHAres Estdish a ie Coling Cent fee on I tratias Aow BSues to chaige an The Durbin Amendment has sparked debate since its 11th-hour addition to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The Federal Reserve has released its final ruling on interchange fees, and the decision requires major changes for big banks, merchants, and consumers alike. HOW IT HAPPENED WHAT THE FED'S RULING MEANS The last-minute amendment submitted Among other stipulations, the Durbin Amendment and the by Senator Richard Durbin assigned the decisions of the Federal Reserve will require the following key Federal Reserve the role of placing a changes: AMENOMENT Establishes a fee ceiling- reasonable and proportional limit on 5 BY SENATOR RICHARD DURBIN a $0.21 fee on all transactions, debit card interchange fees and opened up the interchange networks for down significantly from the 214 competition. previous fee – plus a .05 percent adbvalorem fee for fraud CAP losses based on the transaction amount. Allows issuers to charge an TWO DATES TO IMPLEMENTATION additional $.01 if they comply OVE CENT with certain fraud protection measures. Crone Lets merchats impose a $10 minimum on credit card The new rules take effect. On transactions. In the past, Visa and MasterCard had banned this that date, debit card networks have to honor the $0.21 fee Cheelos practice. cap. OCTOBER Gron 1 Lets merchants offer a 2012 discount to customers who Debit card issuers will have pay with debit or cash. Visa and Mastercard had also to allow debit cards to be processed on at least two previously banned this practice. independent networks. APRIL Gives merchants more choice as to which debit network they process transactions over. HOW IT'S DIFFERENT Changes to fees could affect how merchants operate and how consumers spend. Here's how it would look for the average $38 debit transaction: THE BREAKDOWN PIN Debit Charge: $38.00 Pre-Durbin Charge to Merchant: Post-Dubrin Charge to Merchant: $0.44 $0.24 $0.21-NEW FEE $0.01 FRAUD PREVENTION $0.05% AD VALOREM 44¢ 44¢ = $48 BILLION INTERCHANGE FEES SO FAR .44¢ 44¢ 444 44¢ Swipe fees are typically 1-3 percent of the Though that seems like a small amount, cost of the sale, but some merchants in 2008, merchants and consumers paid are charged as much as 5 precent. $48 billion in interchange fees FREE according to Forbes. WHAT IT MEANS FOR CONSUMERS The Federal Reserve has said it is "unclear" whether consumers will be hurt by or benefit from debit interchange regulation. There are MORE CHARGES FROM BANKS several possible scenarios: Due to the cap, bank revenue from these transaction fees is estimated to fall by 40 percent. As a result, consumers might see the following changes from their banks: New fees on checking accounts Increased minimum balance requirements MYBANK MY BANK End of debit rewards programs MORE SAVINGS FROM MERCHANTS With the possibility of facing lower transaction costs, merchants could pass those savings along to the consumer. As a consumer you might see these savings as an overall reduction in prices or, more likely, as specific discounts on cash/pin-debit card transactions. TRANSACTION SANE I BANK FEES GO DOWN FOR MERCHANTS With interchange fees reduced As processing costs go down, If the merchant chooses to and capped for debit transac- the merchant now decides pass on savings to the tions, merchants set up with whether to keep consumer consumer, this could happen Durbin-friendly pricing will see prices the same and increase in one of two ways: immediate savings on their their profit, or lower their overall credit card processing prices and pass on some or Overall price reduction cost. all of the savings to the consumer. Specific discounts on cash/pin debit transactions Merchant Warehouse SOURCES: NERDWALLET, US NEWS, FORBES, INVESTOPEDIA 10000 D0000 3800

Debit Cards, The Durbin Amendment, And You

Source

http://merch...-overviewCategory

EconomyGet a Quote