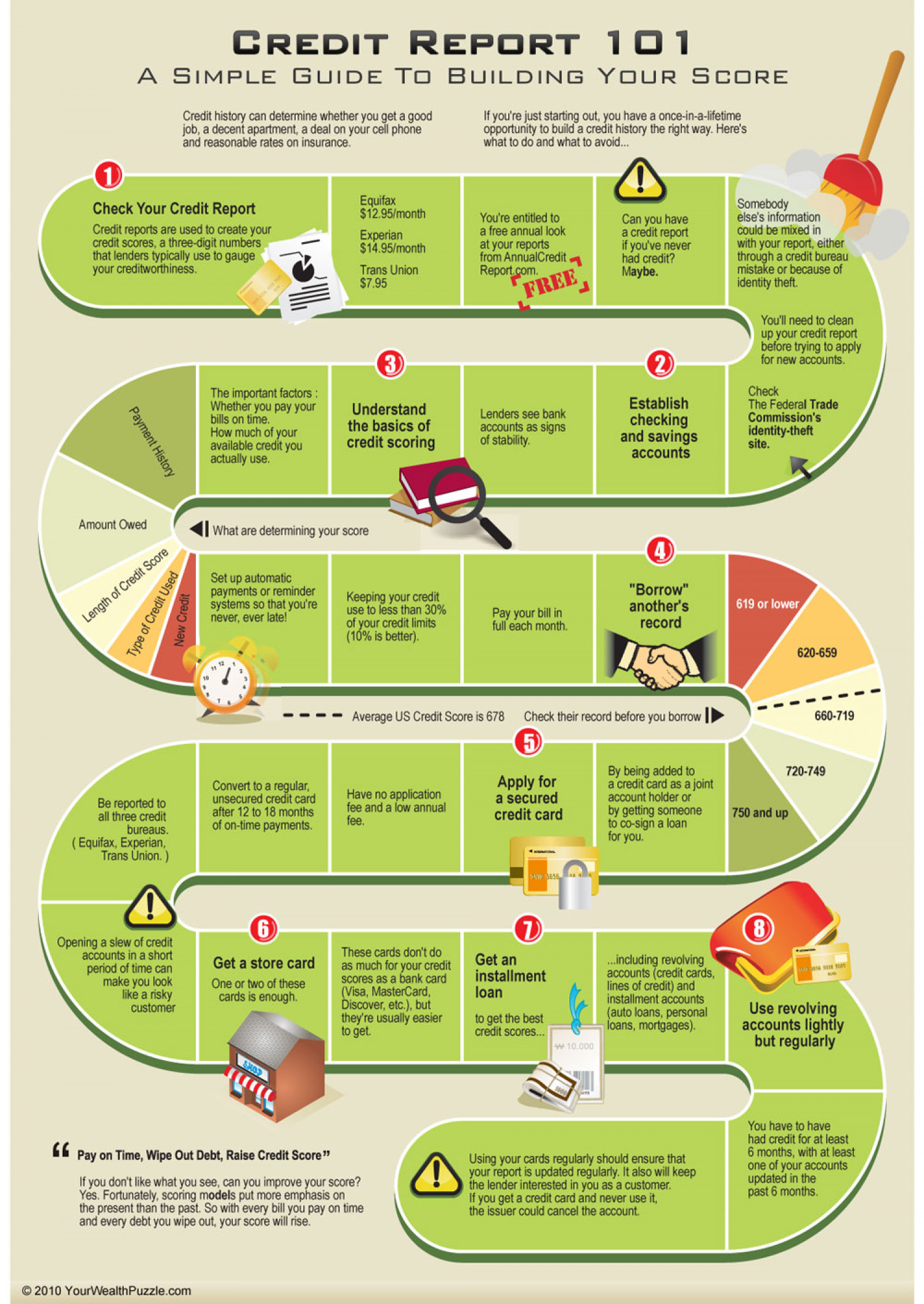

Credit Report 101

CREDIT REPORT 101

A SIMPLE GUIDE TO BUILDING YOUR SCORE

Credit history can determine whether you get a good job, a decent apartment, a deal on your cell phone and reasonable rates on insurance.

If you're just starting out, you have a once-in-a-lifetime opportunity to build a credit history the right way. Here's what to do and what to avoid.

1. Check Your Credit Report

Credit reports are used to create your credit scores, a three-digit number that lenders typically use to gauge your creditworthiness.

Equifax $12.95/month, Experian $14.95/month, Trans Union 7.95

Your entitled to a free annual look at your reports from AnnualCreditReport.com

Can you have a credit report of you've never had credit? Maybe.

Somebody else's information could be mixed in with your report, either through a credit bureau mistake or because of identity theft.

You'll need to clean up your credit report before trying to apply for new accounts.

Check the Federal Trade Commission's identity-theft site.

2. Establish checking and savings accounts

Lenders see bank accounts as signs of stability.

3. Understand the basics of credit scoring

What are determining your score

The important factors: Whether you pay your bills on time.

How much of your available credit you actually use.

Payment history.

Amount owed.

Length of Credit Score.

Type of credit used.

New credit.

Set up automatic payments of reminder systems so that you're never, ever late.

Keeping your cred use to less than 30% of your credit limits (10% is better).

Pay your bill in full each month.

4. "Borrow" another's record

Average US Credit Score is 678. Check their record before you borrow. 619 or lower, 620-659, 660-719, 720-749, 750 and up.

By being added to a credit card as a joint account holder or by getting someone to co-sign a loan for you.

5. Apply for a secured credit card

Have no application fee and a low annual fee.

Convert to a regular unsecured credit card of 12 to 18 months of on-time payments.

Be reported to all three cred bureaus (Equifax, Experian, Trans Union.

Opening a slew of credit accounts in a short period of time can make you look like a risky customer.

6. Get a store card

One or two of these cards is enough.

These cards don't do as much for your credit scores as a bank card (Visa, MasterCard, Discover, etc.) but they're usually easier to get.

7. Get an installment loan to get the best credit scores, including revolving accounts (credit cards, lines of credit) and installment accounts (auto loans, personal loans, mortgages).

8. Use revolving accounts lightly but regularly.

You have to have had credit for at least 6 months, with at least one of your accounts updated in the past 6 months.

Using your cards regularly should ensure that your report is updated regularly. It also will keep the lender interested in you as a customer. If you get a credit card and never use it, the issure could cancel the account.

"Pay on Time, Wipe Out Debt, Raise Credit Score"

If you don't like what you see, can you improve on your score? Yes. Fortunately, scoring models put more emphasis on the present than the past. So with every bill you pay on time and every debt you wipe out, your score will rise. CREDIT REPORT 101 A SIMPLE GUIDE To BUILDING Your SCORE Credit history can determine whether you get a good job, a decent apartment, a deal on your cell phone and reasonable rates on insurance. If you're just starting out, you have a once-in-a-lifetime opportunity to build a credit history the right way. Here's what to do and what to avoid... Equifax $12.95/month Somebody else's information could be mixed in Check Your Credit Report Credit reports are used to create your credit scores, a three-digit numbers that lenders typically use to gauge your creditworthiness. You're entitled to a free annual look at your reports from AnnualCredita Report.com. Can you have a credit report if you've never had credit? Maybe. Experian $14.95/month with your report, either through a credit bureau mistake or because of identity theft. Trans Union $7.95 FREE r. You'll need to clean up your credit report before trying to apply for new accounts. 3) The important factors Whether you pay your bills on time. How much of your available credit you actually use. Understand the basics of credit scoring Establish checking and savings Check The Federal Trade Commission's identity-theft site. Lenders see bank s as signs of stability. accounts Amount Owed What are determining your score Set up automatic payments or reminder systems so that you're never, ever late! Keeping your credit use to less than 30% of your credit limits (10% is better). "Borrow" another's record 619 or lower Length of Credit Score Pay your bill in full each month. 620-659 - Average US Credit Score is 678 Check their record before you borrow 660-719 5) By being added to a credit card as a joint account holder or by getting someone to co-sign a loan for you. 720-749 Be reported to all three credit bureaus. (Equifax, Experian, Trans Únion. ) Convert to a regular, unsecured credit card after 12 to 18 months of on-time payments. Have no application fee and a low annua fee. Apply for a secured credit card 750 and up Opening a slew of credit accounts in a short period of time can make you look like a risky customer These cards don't do as much for your credit scores as a bank card (Visa, MasterCard, Discover, etc.), but they're usually easier to get. Get an installment loan .including revolving accounts (credit cards, lines of credit) and installment accounts (auto loans, personal loans, mortgages). Get a store card One or two of these cards is enough. Use revolving accounts lightly but regularly to get the best credit scores... W10.000 You have to have had credit for at least 6 months, with at least one of your accounts updated in the past 6 months. Pay on Time, Wipe Out Debt, Raise Credit Score" If you don't like what you see, can you improve your score? Yes. Fortunately, scoring models put more emphasis on the present than the past. So with every bill you pay on time and every debt you wipe out, your score will rise. Using your cards regularly should ensure that your report is updated regularly. It also will keep the lender interested in you as a customer. If you get a credit card and never use it, the issuer could cancel the account. © 2010 YourWealthPuzzle.com Payment History Type of Credit Used

Credit Report 101

Source

Unknown. Add a sourceCategory

EconomyGet a Quote