45 Bits of Wisdom From Great Investor Jim Rogers

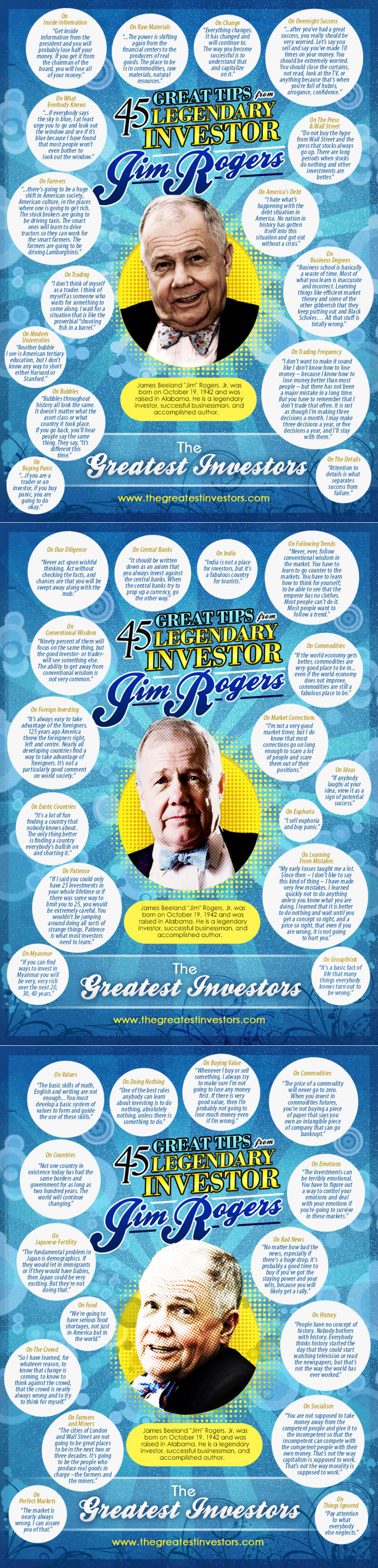

On Inside Information On Change "Everything changes. It hás changed and will continue to. The way you become successful is to understand that and capitalize on it." On Overnight Success ".after you've had a great success, you really should be very worried. Let's say you sell'and say you've made 10 times on your money. You should be éxtremely worried. You should close the curtains, not read, look at the TV, or anything because that's when you're full of hubris, arrogance, confidence." On Raw Materials "Get inside information from the president and you will probably lose half your money. If you get it from the chairman of the board, you will lose all of your money." ". The power is shifting again from the financial centers to the producers ofreal goods. The place to be is in commodities, raw materials, natural resources." On What Everbody Knows .if everybody says the sky is blue, lat feast urge you to go and look out the window and see if it's blue because I have found that most people won't even bother to look out the window." GREAT TIPS pem LEGENDARY INVESTOR On The Press & Wall Street "Do not buy the hype from Wall Street and the press that stocks always go up. There are long períods when stocks do nothing and other investments are better." Jin Regers On Farmers ".there's going to be a huge shift in American society, American culture, in the places where one is going to get rich. The stock brokers are going to be driving taxis. The smart ones will learn to drive tractors so they can work for the smart farmers. The farmers are going to be driving Lamborghinis." On America's Debt "I hate what's happening with the debt situation in America. No nation in history has gotten itself into this situation and got out without a crisis. On Business Degrees "Business school is basically a waste of time. Most of what you learn is inaccurate and incorrect. Learning things like efficient market theory and some of the other gibberish that they keep putting out and Black Scholes... All that stuff is totally wrong." On Trading "I don't think of myself as a trader. I think of myselfas someone who waits for something to come along. I wait for a situation that is like the proverbial "shooting fish in a barrel." On Modern Universities "Another bubble I see is American tertiary education, but I don't know any way to short either Harvard or Stanford." On Trading Frequency "I don't want to make it sound li ke I don't know how to lose money – because I know how to lose money better than most people – but there has not been a major mistake in a long time. But you have to remember that don't trade that often. It is not as though I'm making three decisions a month. I may make three decisions a year, or five decisions a year, and l'll stay with them." James Beeland "Jim" Rogers, Jr. was born on October 19, 1942 and was raised in Alabama. He is a legendary investor, successful businessman, and accomplished author. On Bubbles "Bubbles throughout history all look the same. It doesn't matter what the asset class or what country it took place. If you go back, you'll hear people say the same thing. They say, "It's different this time" The Greatest Investors On The Details "Attention to details is what On Buying Panic "ifyou are a trader or an investor, if you buy panic, you are going to do okay." separates success from failure. www.thegreatestinvestors.com On Following Trends "Never, ever, follow conventional wisdom in the market. You have to learn to go counter to the markets. You have to learn how to think for yourself; to be able to see that the emperor has no clothes. Most people can't do it. Most people want to follow a trend." On Due Diligence On Central Banks "Never act upon wishful thinking. Act without checking the facts, and chances are that you will be swept away along with the mob. "It should be written down as an axiom that you always invest against the central banks. When the central banks try to prop up a currency, go the other way. On India "India is not a place for investors, but it's a fabulous country for tourists." GREAT TIPS nem 45LEGENDARY INVESTOR On Conventional Wisdom "Ninety percent of them will focus on the same thing, but the good investor- or trader- will see something else. The ability to get away from conventional wisdom is not very common. On Commodities "If the world economy gets better, commodities are very good place to be in. even if the world economy does not improve, commodities are still a fabulous pla ce to be." Jim Regers On Foreign Investing "It's always easy to take advantage of the foreigners. 125 years ago America threw the foreigners right, left and centre. Nearly all de veloping countries find a way to take advanta ge of foreigners. It's nota particularly good comment on world society." On Market Corrections "I'm not a very good market timer, but I do know that most corrections go on long enough to scare a lot of people and scare them out of their positions. On Ideas "If anybody laughs at your idea, view it as a sign of potential success." On Exotic Countries On Euphoria "I sell euphoria and buy panic." "It's a lot of fun finding a country that nobody knows a bout. The only thing better is finding a country everybody's bullish on and shorting it." On Learning From Mistakes "My early losses taught me a lot. Since then -I don't like to say this kind of thing - T have made very few mistakes. I learned quickly not to do anything unless you know what you are doing. (learned that it is better to do nothing and wait until you get a concept so right, and a price so right, that even if you are wrong, it is not going to hurt you." On Patience "If I said you could only have 25 investments in your whole lifetime or if there was some way to limit you to 25, you would be extremely careful. You wouldn't be jumping around doing all sorts of strange things. Patience is what most investors need to learn." James Beeland "Jim" Rogers, Jr. was born on October 19, 1942 and was raised in Alabama. He is a legendary investor, sucessful businessman, and accomplished author. On Myanmar "If you can find ways to invest in Myanmar you will be very, very rich over the next 20, 30, 40 ye ars." On Groupthink "It's a basic fact of life that many things everybódy knows turn out to be wrong." The Greatest Investors www.thegreateştinvestors.com On Buying Value "Whenever I buy or sell something, I always try to make sure l'm not going to lose any money first. If there is very good value, then l'm probably not going to lose much money even if I'm wrong. On Values On Commodities "The basic skills of math, English a nd writing are not enough.. You must develop a basic system of values to form and guide the use of these skills." On Doing Nothing "One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do." "The price of a commodity will never go to zero. When you invest in commodi ties futures, you're not buying a piece of paper that says you own an intangible piece of company that can go bankrupt." GREAT TIPS pam 45LEGENDARY INVESTOR On Countries On Emotions "Not one country in existence today has had the same borders and government for as long as two hundred years. The world will continue changing. "The investments can be terribly emotional. You have to figure out a way to control your emotions and deal with your emotions if you're going to survive in these markets." JimRegers On Japa ne se Fertility "The fundamental problem in Japan is demographics. If they would let in immigrants or íf they would have babies, then Japan could be very exciting. But they're not doing that." On Bad News "No matter how bad the news, especially if there's a huge drop, it's probably a good time to buy if you've got the staying power and your wits, because you will likely get a rally." On Food "We're going to have serious food shortages, not just in America but in the world." On History "People have no concept of history. Nobody bothers with history. Everybody thinks history started the day that they could start watching television or read the newspapers, but that's not the way the world has ever worked." On The Crowd "So I have learned, for whatever reason, to know that change is coming, to know to think against the crowd, that the crowd is nearly always wrong and to try to think for myself." On Socialism On Farmers and Miners "The cities of London and Wall Street are not going to be great places to be in the next two or three decades. It's going to be the people who produce real goods in charge -the farmers and the miners." "You are not supposed to take money away from the competent people and give it to the incompetent so that the incompetent can compete with the competent people with their own money. That's not the way capitalism is supposed to work. That's not the way morality is supposed to work." James Beeland "Jim" Rogers, Jr. was born on October 19, 1942 and was raised in Alabama. He is a legendary investor, successful businessman, and accomplished author. The On Perfect Markets "The market is nearly always wrong. I can assure you of that." Greatest Investors On Things Ignored "Pay attention to what everybody else neglects." www.thegreatestinvestors.com

45 Bits of Wisdom From Great Investor Jim Rogers

Source

http://www.d...Jim-RogersCategory

BusinessGet a Quote